Investing in monthly dividend stocks is one of the most consistent ways to make a solid income in the long run.

This is true for many investors, including retirees and beginner investors looking for passive income.

But which monthly dividend stocks should you choose?

We have rounded up 7 stocks that pays dividends every month. The list is compiled according to recency, popularity, and how suitable it is for most investors.

- The Best Stocks That Pays Dividends (Overview)

- Stocks That Pay Monthly Dividends: An Overview

- Features to Look for When Choosing Your Stock Options

- Best Monthly Dividend Stocks: Our Top 3 Options [Ranked & Reviewed]

- Notable Mentions: Other Stocks You Should Keep an Eye Out On

- Similar Investment Opportunities to Check Out

- Frequently Asked Questions

- Wrapping Up

The Best Stocks That Pays Dividends (Overview)

Here’s a breakdown of the best monthly dividend stocks to consider in 2023:

- Our Pick: Realty Income

- Runner-Up: Green Realty Corp.

- Also Great: Stag Industrial

- Other Notable Mentions

- Safe Choice: Main Street Capital Corp.

- Flexible: Ellington Financial

- Diverse: Gladstone Commercial

- High Yields: Oxford Square Capital

Stocks That Pay Monthly Dividends: An Overview

If you ever wondered why people invest in monthly dividend stocks, here are some important points to consider.

We will also touch on the benefits and drawbacks of monthly dividends, so you can have a better overview when choosing a company to invest in.

What Are Stocks and Dividends?

In financial terms, stocks (also known as equities) are securities that represent a certificate with a monetary value that can be bought, sold, or traded.

If you own a certain number of a chosen company stock, you are regarded as a shareholder that owns a fraction of the company or corporation in proportion to its total shares in percentage.

Now, dividends are payments given out to shareholders by the companies they’ve invested their stocks.

Typically, stock dividends are paid out to shareholders either annually or on a quarterly basis (every 3 months), but some companies choose to pay these on a monthly basis.

What Are Monthly Dividend Stocks?

Monthly dividend stocks are stocks that pay dividends every month. A company that offers monthly dividends is an indicator that they have a stable cash flow with decent profits that offer lucrative recurring revenue.

That being said, very few companies offer monthly dividend stock options. The most popular ones are Main Street Capital, SL Green Realty, and Stag Industrial Incorporated, among others.

The company’s board of directors is responsible for approving the dividend, as well as announcing when, how much, and with which rates it will be paid.

For example, if a company’s board of directors issues a 5% dividend per share every year that’s worth $120, the dividend is $6 at the end of each year. If they issue the dividends every month, the distribution is calculated accordingly, or $0.5 every month.

If the company earned more profits during that time period, they’re able to pay a fraction of the profit to the shareholders.

Building Your Investment Portfolio With Dividend Payments

What’s good about monthly dividend stocks is that investors are free to choose whether they want to collect their payments, or if they feel the stocks have potential, they can reinvest the dividend payments to build their portfolio.

Most investors who are looking for a consistent form of stable income usually choose companies that offer monthly dividends. But, this type of investment is also great if you’re an investor who is working on your portfolio.

Portfolio management and investment advisory services like FutureAdvisor can greatly help with your current investment opportunities if you’re struggling with your rebalances and finding low-fee index funds.

Do I Need to Invest in Monthly Dividend Stocks?

There are many real estate investment trust companies (REITs) that pay dividends on a monthly basis because they are legally obliged to annually distribute at least 90% of their taxable income to shareholders.

One of the main reasons why you should invest in monthly dividend stocks is because it offers a faster payout in contrast to long-term dividend payouts.

For shareholders looking for a faster payoff, investing in monthly dividend stocks can be a stable and even lucrative form of income because there are many stock options with an above-average dividend yield.

Advantages Of Monthly Dividend Stocks

- Passive income: The main selling point of monthly dividends is that they offer investors a consistent and more frequent income.

- Reinvesting in more stocks: The consistent income opens a window of opportunity to consider other stock options and reinvest in other passive income ideas.

- Building your portfolio: Owning monthly dividend stocks is a great method of boosting your dividend retirement portfolio.

- Growing profit means increased payments: Your dividend payments increase proportionally to the company’s growing profits.

- Stability: Companies that pay out dividends on a monthly basis normally have a stable dividend yield with minimal risk margins.

Disadvantages Of Companies That Pay Monthly Dividends

- Too few to choose from: Monthly dividend stocks are scattered in just a few stock market sectors, and most of them are speculative. Approximately 50 out of 3,000 companies in the US pay monthly dividends, which isn’t exactly a wide variety of options to choose from.

- Wide dividend gaps: There’s always the risk of a sharp decline in dividend quotes after the dividends are paid. This is owed to multiple factors, which include weakening earnings and the company’s limited funds to meet dividend payment demands.

- Too reliant on net profit: Most companies’ dividends are directly distributed from their net profit, and this can prove dangerous for their future business plans and long-term development.

- Heavy taxes: Most countries in the US impose heavy taxes on dividends. Always do your research on the company you’re investing in.

- Higher risk of cancellation: Companies do not guarantee monthly dividend payments and can always be canceled because companies that issue monthly dividends are usually in debt which further puts the dividend safety at risk.

Features to Look for When Choosing Your Stock Options

Monthly dividends can be very suitable for most investors.

However, don’t be distracted by the benefits of a consistent monthly payout because the company’s stocks still depend on many factors, like the economy and the stability of the market.

If you’re looking to invest in monthly dividend stock options and turn them into a fruitful passive income, you should carefully consider the following points:

1. Focus on companies with a strong business model.

Corporations with a resilient business model tend to prosper when the economy is healthy and still maintain a solid financial posture when the economy is bad.

This allows them to issue their dividends in a timely and proper manner without having to cut on dividend payouts when they struggle with other financial hardships.

2. Look for sustainable dividends.

It’s critical that you first research the companies you invest in, as well as keep a close eye on the stock market. This ensures you safely invest in sustainable dividends that offer a more consistent yield.

There’s always a risk of the company cutting the payout, which can drastically lower the stock. For example, when purchasing a 5% dividend stock and then having it watch tumbling down 20% when it has to diminish the payout.

3. Invest in businesses with a higher-than-average recurring revenue.

These businesses are usually real estate companies with a strong subscription system. They offer decent stability and a higher chance of paying out cemented sums.

In the meantime, if you believe you have the right stocks for it, starting a real estate business on your own can also be a very lucrative venture.

4. Diversify your stocks.

While monthly dividend stocks are scarce, it’s still a bad idea to put all your funds in just a handful of monthly dividend issuers.

If you want a strong stream of income with less risk of losing money, you should look to diversify your stocks with closed-end funds (CEFs).

CEFs can fluctuate when the stock market becomes too volatile to handle, so try to trade below the net asset value (your total asset price without the debt numbers) because you’ll have a significant margin of safe trading which can protect your diversified stocks.

Best Monthly Dividend Stocks: Our Top 3 Options [Ranked & Reviewed]

Here’s our ultimate round-up of the most popular monthly dividend stocks.

Our Top Pick: Realty Income (O (NYSE))

We’ll start with a very popular and stable pick.

Realty Income has been in the stock market business since 1969 and is regarded as the epitome of a monthly dividend payer.

Founded in San Diego, California, Realty Income is a large-cap retail REIT that invests in single-tenant properties that are subject to NNN Leases and owns approximately over 12,000 commercial retail properties in many different industries.

They mainly focus on premium, top-paying locations with long-term lease agreements. Despite the pandemic and financial crisis in recent years, their tenants’ occupancy rate has always been over 95%.

As a member of the S&P 500 and the prominent Dividend Aristocrats index, it has one of the most stable, recession-proof stocks that pay monthly dividends.

Key Features:

- Sector: Real Estate (Retail REITs)

- Market cap: $40.37 billion

- Annual dividend yield: 5.1%

- Quarterly dividend amount: $0.76

- Dividend safety score: Safe

- Yield attractiveness: A+

- Uninterrupted dividend streak: 53+ years

Pros:

- Prominent company with a respected track record: Realty Income has a history of increasing growth which promises solid dividend statistics. What makes this corporation so special is that it has an unbroken track record of paying out more than 600 monthly dividends since 1969.

- Strong cash flows: Realty Income generates its cash flow from rent collected from wealthy tenants with excellent credit scores. The rents have a service price point aspect tied to their business. This makes them almost “Amazon-proof,” avoiding direct competition with e-commerce giants like Amazon.com. The cash flow guarantees regular dividend payoffs with cemented confidence.

- Constant dividend yield increase: Since its first public stock market opening in 1994, Realty Income has increased its dividend more than 100 times, and the payout has been increased at an annual rate of 4.5%. As of May 2023, the company pays an annual dividend yield of 5.1% to its stockholders.

Cons:

Recent stock prices have been increasingly dropping: Realty Income’s shares have been underperforming as of late and have dropped 0.17% to $59.97. This might scare off some investors who are looking for shares with a lower-than-average cost.

Verdict:

When it comes to consistent dividend payoffs, no other company comes close to the unbeatable track record of Realty Income.

While their stock is slightly underperforming in May 2023, their income stream is expected to grow in the coming years, which puts them in a very stable and safe position.

Acquiring VEREIT Inc. back in 2021, as well as purchasing approximately $6 billion in small-deal properties, can greatly increase their cash flow in the future.

As for future endeavors, the company expects to keep expanding its portfolio with new acquisitions while maintaining its strong balance sheet throughout 2023 and 2024.

Runner-Up: SL Green Realty Corp. (SLG)

Here’s another real estate giant.

Maintaining a strong investment company grip in the Big Apple since 1997, SL Green is a New York-based REIT real estate investment trust company that deals with office real estate, and it holds interest in over 60 office buildings.

As Manhattan’s biggest office real estate owner, the vast majority of SL Green’s main income comes from wealthy Manhattan office buildings that have serious occupancy rates and high rents in contrast to other REITs.

This ‘bread and butter’ is what makes it a famous high-yield investment corp that can suit many NY-focused investors.

Key Features:

- Sector: Real Estate (Office REITs)

- Market cap: $1.45 billion

- Annual dividend yield: 14.42%

- Quarterly dividend amount: $0.81

- Dividend safety score: Unsafe

- Yield attractiveness: A

- Uninterrupted dividend streak: 0 years

Pros:

- High yield: There’s no doubt SL Green deals with high numbers. The promise of a consistent monthly dividend payoff relies on a luxurious rental income from long-term leases and big names like Credit Suisse and ViacomCBS. As of May 2023, SL Green pays off its investors a monthly dividend of $0.271 per share for a dividend yield of 14.42%.

- Strong choice in an attractive real estate market: As a reputable, high-end REIT, SL Green focuses on office buildings that are targeted by corporate investors that offer predictable income, which opens a window of opportunity for selling properties at high prices.

- Pandemic survivor: While the pandemic and the hype over remote work had drastically impacted the demand for office space, SL Green managed to balance their cash flow, with high-paying properties, diverse tenant groups, and minimal lease expiry.

- Trusted by giants: As of the final quarter of 2022, their biggest stakeholder remains Marshal Wace LLP with approximately 1.5 million shares.

Cons:

- New York City is the limit: While SL Green’s high yield may be attractive for some, investments are only limited to the buildings in New York City. In contrast to the other companies’ diversified stock nature, putting funds exclusively in New York City can be extremely risky.

- Discounted trading: In contrast to previous years, SL Green is currently trading at discount numbers, which aren’t suitable for stock traders that may consider long-term investment plans with SL Green.

- Possible risks: Despite overcoming financial post-pandemic hurdles, SL Green’s high leverage, future debts, and uncertain occupancy rates may result in higher dividend cuts which can have an even more negative impact if they fail to sell their assets this year.

Verdict:

Although SL Green’s shining dividend yield is guaranteed by New York’s most expensive office squares, it’s still regarded as a speculative firm, especially for investors who prefer to assess their stock options carefully.

This is emphasized by the cash flow in the face of the rising costs of borrowing and higher costs of property renovation due to frequent leasing.

SL Green has an ever-teetering dividend status with a taxable income. Their bold, short-term policy can be very lucrative in 2023, but only for the bravest stock jugglers who seek high yields with a high risk.

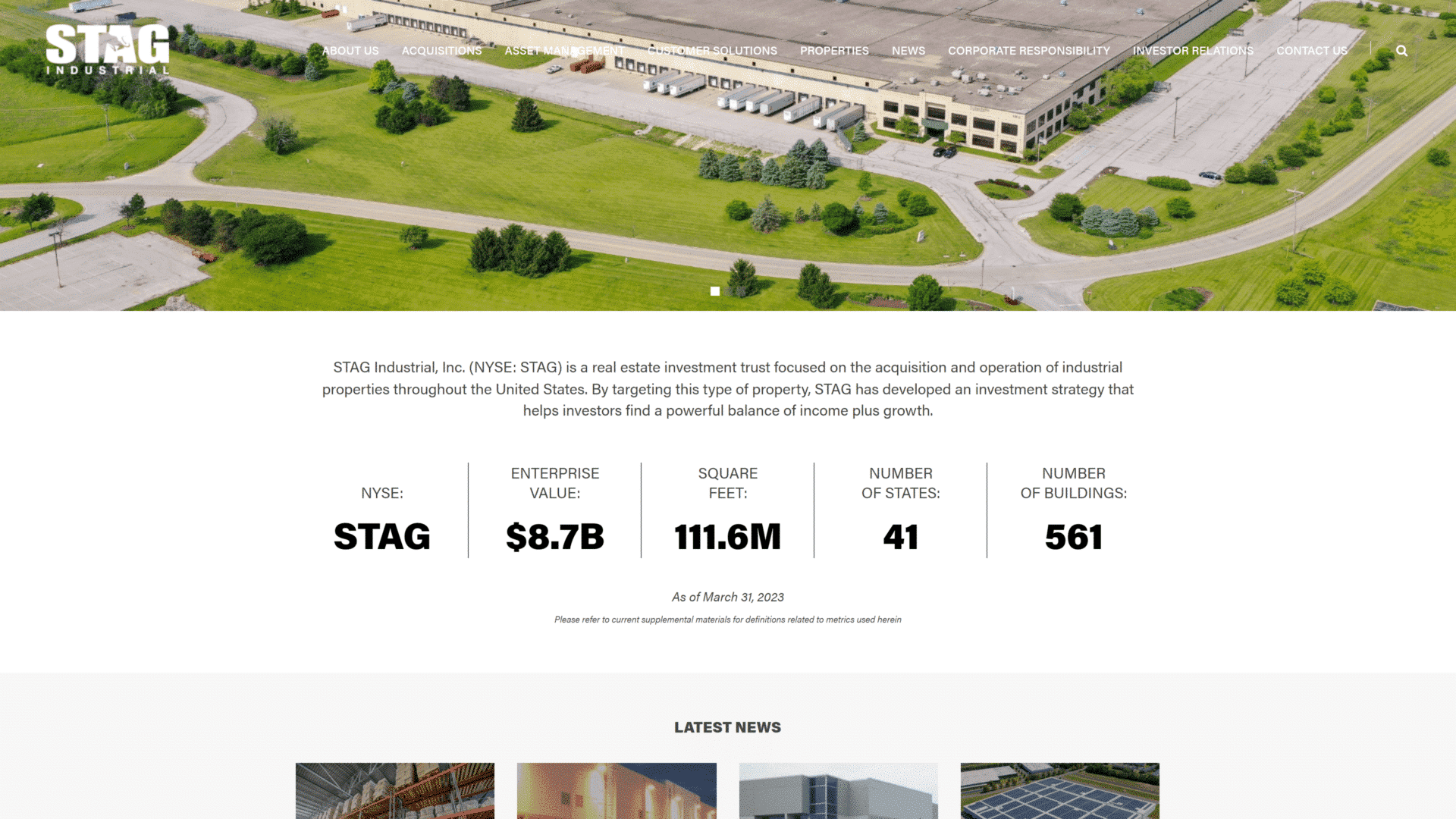

Also Great: Stag Industrial (STAG)

Moving onto industrial properties.

Established in 2003, Stag Industrial is a REIT powerhouse with over 500 industrial real estate buildings, warehouses, logistics centers, and other manufacturing spaces.

Generally regarded as a cyclical, mid-cap REIT, Stag deals with single-tenant properties across 40 different industries like automotive, construction, and heavy metal machinery.

Most of these industries heavily rely on economy-sensitive markets but combine the short average lease terms and mid-range tenants. This allows for higher lease renewal and lower stock risks when a recession hits.

We mentioned “Amazon-proof.” In contrast to competitors who are steering clear of Amazon’s way, Stag Industrial thrives in e-commerce environments.

In fact, Stag’s most active tenant is Amazon. This is one of the main reasons why Stag Industrial is a low-risk, sweet spot for cautious investors.

Key Features:

- Sector: Real Estate (Industrial REITs)

- Market cap: $6.17 billion

- Annual dividend yield: 4.27%

- Quarterly dividend amount: $0.37

- Dividend safety score: Safe

- Yield attractiveness: A-

- Uninterrupted dividend streak: 10 years

Pros:

Operates in most U.S. states: Stag Industrial operates in 41 states and owns more than 560 buildings and approximately 111 million square feet of land. This roughly translates to a stable income, well-thought-out hedges, and a promising cash flow.

Recent dividend boost: Stag successfully boosted the dividends in recent years, all thanks to the moderate leverage, good credit rating, and the expanded portfolio that includes lots of properties and buildings.

Guaranteed dividend payoff: Although almost 50% of Stag’s properties operate with e-commerce and online businesses, its monthly dividend consistency relies on the ever-increasing demand for logistics and supply chain maintenance.

Cons:

High price-to-earning ratio: Stag Industrial has a relatively high price-to-earning ratio of 35.3. While some may consider this average, this is not suitable for investors who are trying to avoid industrial stocks entirely. Stag’s estimated market value is around $1 trillion, which might explain the high ratio.

Verdict:

It’s not unusual to see a slow-moving, industrial giant like Stag reaping the benefits from the e-commerce spikes that followed the pandemic.

Although it has greatly dissipated since, there’s still an unwavering trend of online purchases.

Stag is expected to grow very slowly, almost at a moss-like pace. But, this slow and steady tempo may suit some investors just fine, especially those who are comfortable with cyclical stocks that promise a monthly income.

Notable Mentions: Other Stocks You Should Keep an Eye Out On

Safe Choice: Main Street Capital Corp. (MAIN)

Main Street Capital is a private equity business development company (BDC) known for debt and equity financing for low-mid companies with revenues from $10 million to $150 million.

Since the mid-1990s, Main Street has helped hundreds of private companies flourish. Their successful financing model only aims for promising companies that possess a competitive edge, sharp business structures, and rock-solid cash flows.

- Sector: Financial (Business Development)

- Market cap: 3.16 billion

- Annual dividend yield: 6.87%

- Quarterly dividend amount: $0.68

- Dividend safety score: Safe

- Yield attractiveness: A

- Uninterrupted dividend streak: 14 years

Why is it a great option?

- Excellent track record: In comparison to its competitors, Main Street has an impeccable record of never cutting its frequent monthly dividend of 14 years, counting the two recessions.

- Diverse portfolio: The firm’s success begins with its diversified portfolio, which consists of mostly high-yield loans made to more than 150 companies.

Drawbacks:

- Dwindling dividend numbers: Recently, Main Street has been struggling with underperforming stocks, shedding around $225 million from its total market cap.

Verdict:

Main Street is great for investors who are looking for secure stocks. The company is protected against loan losses, and decent insulation from market mishaps, all thanks to never having their investment exceed a 5% mark of their portfolio’s total income.

The strict leverage policy dictates never going into debt that’s not recommended by regulatory commissions, and this earns Main Street an exemplary investment grade.

Ellington Financial (EFC)

Founded in 2007, Ellington Financial is a real estate credit company that focuses on corporate loans, consumer debt services, and other related financial assets. But, their main source lies in mortgage-backed stocks with residential and commercial mortgages.

- Sector: Financial (Mortgage REIT)

- Market cap: $852.28 million

- Annual dividend yield: 14.18%

- Quarterly dividend amount: $0.45

- Dividend safety score: Unsafe

- Yield attractiveness: B+

- Uninterrupted dividend streak: 1 year

Why is it a great option?

Ellington’s colorful portfolio allows for a more flexible capital allocation with varying interest rates, and it helps reduce unpredictable investment returns.

While the risk of loan loss is very present in these financial sectors, Ellington protects itself from these sectors that are prone to being victims of the economy.

Drawbacks:

High-interest rate sensitivity: Although the credit risk is almost non-existent, the interest rate sensitivity is extremely high. This makes their monthly dividend stock easily challenged by high leverage.

Prone to dividend slashes: In 2020, Ellington’s lenders started to doubt the whole pandemic situation, which prompted the firm to cut down their dividends in half to protect liquidity.

Verdict:

Ellington’s diverse portfolio and promising yields are what make it a lucrative choice in this saturated industry, but like all hybrid mortgage REITs, it’s pretty volatile.

Gladstone Commercial (GOOD)

Gladstone Commercial handles real estate as a diversified REIT that concentrates on net-leased office, medical, retail, and industrial properties with almost 48% of its portfolio.

This diverse portfolio generates a stable income that, in turn, promises a consistent monthly dividend. Most importantly, Gladstone managed to execute more than 200 consecutive monthly dividends with a high yield and moderate growth.

- Sector: Real Estate (Diversified REIT)

- Market cap: $498.70 million

- Annual dividend yield: 10.54%

- Quarterly dividend amount: $0.30

- Dividend safety score: Unsafe

- Yield attractiveness: B-

- Uninterrupted dividend streak: 18 years

Why is it a great option?

Diverse portfolio: While Gladstone is a small firm, their portfolio contains a diverse variety of 130 office and industrial properties in 20 industries, and its tenants don’t exceed 4% of rent costs.

Drawbacks:

Dividend slash of 2023: Since 2004, Gladstone has managed to pay their dividends until they decided to do a %20 slash at the beginning of 2023, hence their ‘Unsafe’ rating.

Verdict:

Gladstone reaps the benefits of having creditworthy tenants with consistent occupancy. Although they have dealt with financial difficulties before, Gladstone has many qualities that make up for their unsafe margins. Still, conservative investors should be careful when investing in this firm.

Oxford Square Capital (OXSQ)

Oxford Square is another business development company that has operated since 2003 and deals with corporate loans and collateralized loan obligations (CLO) that focuses investments on mid-tier companies with revenues of less than $200 million.

This strategy revolves around the benefits of dealing with companies large enough to be regarded as strong but small enough to be barred from accessing traditional financing from bank branches.

- Sector: Financial (Business Development)

- Market cap: 149.20 million

- Annual dividend yield: 14.05%

- Quarterly dividend amount: $0.11

- Dividend safety score: Very unsafe

- Yield attractiveness: C+

- Uninterrupted dividend streak: 0 years

Why is it a great option?

High yields: Oxford’s loans offer solid monthly dividend yields that reflect increased credit risk.

Ambitious investment with a balanced portfolio: Compared to its competitors, Oxford is known for hostile investments with a portfolio that includes second-lien secured debt and CLO equity in general. Their securities have a floating interest rate that boosts their income when the rates rise, allowing for a more balanced portfolio.

Drawbacks:

Unstable: Oxford can suffer negative financial impacts once recession hits and loan defaults skyrocket.

Verdict:

When compared to BDCs with more conservative investment strategies, Oxford has significantly less diverse portfolios.

If you are looking for stable dividends, this firm has an extremely high risk but decent yields. Investors should focus on this firm once the economic instabilities have calmed down.

Similar Investment Opportunities to Check Out

If you’re interested in stock market trading and you’re looking for helpful guides and tools for low-cost equity investments. You can find lots of apps that can greatly help with your stock market investment or help you catalyze your ideas.

Here are some useful tutorials and AI-powered tools to consider:

- Wealthsimple: This is an automated investing service that helps you with long-term wealth investment opportunities. It has a plethora of automated tools that do all the heavy lifting for you and provides calculated statistics backed by financial experts to help you invest money in the stock market with excellent returns on investment.

- Betterment Investing: Another great tool for investment and financial management is Betterment Investing. Using robo-advisors, this financial advisory company can help you put your savings to good use and offers insight and advisory tactics for digital investment and retirement options.

- Real Estate Crowdfunding: If you’re interested in real estate investment to make money in the long run, this guide will show you the basics of real estate crowdfunding. Real estate crowdfunding can help you pool your money together with other like-minded investors without the hassle of regular real estate investment methods.

Frequently Asked Questions

We’ll try to answer any questions you might have about stocks that pay monthly dividends and the importance of dividends in general.

Can I Withdraw Dividends Monthly?

Yes, you can withdraw dividends from companies that offer a monthly payout.

Some investors find the monthly frequency very suitable for their investment strategies, and it can help investors properly structure their budgets, save time, and open windows for new investment opportunities.

Keep in mind that dividends depend on the company’s profits, so the payoff might fluctuate.

What Is the Average Dividend Yield From Monthly Dividend Stocks?

Monthly dividend stocks typically have a dividend yield between 7% and %19 on average.

Depending on the stock market, monthly dividend stocks can be profitable for some investors.

As of March 2023, approximately 280 monthly dividend stocks with an above-average market cap of $250 million have a median dividend yield of around 8%.

Is It Worth Investing in Stocks That Pay Monthly Dividends?

Absolutely. If you invest properly and diversify your assets, having monthly dividend stocks makes sure you’ll have a consistent income, especially if you’re a retiree looking to put your residual income to good use.

Remember that these dividend stocks focus on sectors like real estate, private equity securities, and energy, which don’t provide business growth opportunities in comparison to technology.

Wrapping Up

Getting paid on a monthly basis sounds attractive to investors. But, it’s important to remember that dividend sustainability should be considered one of the more crucial factors in creating a suitable investment strategy.

You should focus on reputable corporations with a strong business model and recurring revenue. This is why we picked Realty Income (O (NYSE)) as a solid example of a well-balanced corporation that offers monthly dividends suitable for most investors.

Otherwise, if you’re an individual or you own a business, create a free account on Gigworker to unlock your full potential for investment.

Disclaimer: Gigworker.com is not an investment adviser and does not offer financial advisory services. The information provided in this article should not be regarded as such. This article is only intended for educational purposes.

Data is accurate as of May 2023 and may be subject to change. For more accurate information on other shares, feel free to browse the stock research resources like NASDAQ.