Are you a freelancer concerned about retirement?

Perhaps you’ve begun earning passive income so that you can start investing.

Regardless, you may find investing is a challenging path.

The past decade or so has seen a rise in the number of robo-advisors available online that make investing more accessible than ever.

According to Fidelity, robo-advisors are investment management companies that “provide financial services and investing advice in a similar way that a traditional human financial advisor would.”

To get started, you’ll answer a few questions about your risk tolerance and fund the account.

Then, an algorithm will determine which investment strategy is right for you and invest accordingly.

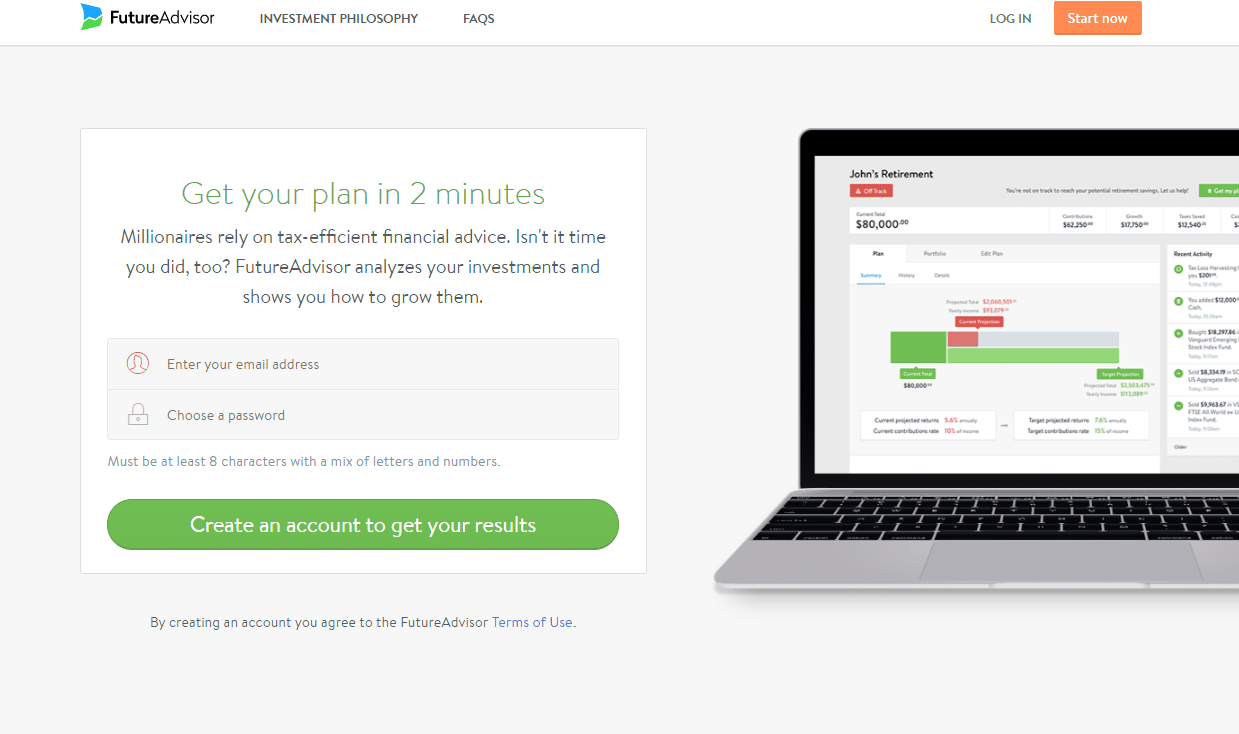

One such robo-advisor investment option that you can choose is Blackrock’s FutureAdvisor.

Below, you’ll find a complete FutureAdvisor review.

We’ll detail what FutureAdvisor is and how it could help you build a strong investment portfolio.

What Is FutureAdvisor?

FutureAdvisor is a fiduciary company based in San Francisco, California.

The company provides portfolio management and investment advisor services to investors.

According to the company website, the “portfolio management service automatically monitors, rebalances, and tax-manages your current investments, adding low-fee index funds where necessary to bolster your portfolio.”

Bo Lu and Jon Xu founded the company in 2010, making it one of the first companies to break the mold of financial advisory and shift into algorithm-based wealth management.

The firm has credible backers, including the largest investment firm in the world, Blackrock, as well as TD Ameritrade and Fidelity Investments.

The company believes in Modern Portfolio Theory (MPT).

This theory, introduced in 1952 by economist Harry Markowitz, defines how investors can maximize their returns to match their risk aversion.

Modern Portfolio Theory is based on mathematical equations.

Each investment portfolio has risk and return characteristics based on its various components.

As TD Ameritrade describes, “for each level of risk, there is an ‘optimal’ asset allocation that is designed to produce the best balance of risk versus return.”

The team at FutureAdvisor is made of finance professionals, software engineers, and data scientists.

Blackrock is registered with the US Securities and Exchange Commission, so customers can trust that the firm is reliable and safe.

How Does FutureAdvisor Work?

To use the service, you need to have an account with either TD Ameritrade or Fidelity.

If you own other funds, you can transfer them into your FutureAdvisor account.

Unfortunately, there is no way around this.

Some may view this as a benefit, since FutureAdvisor will provide a complete snapshot of your personal finance.

If you already own investment accounts with TD Ameritrade and Fidelity, FutureAdvisor will merely serve as an additional management layer.

Upon signing up, FutureAdvisor will rebalance your portfolio so that it fits within your target allocation.

After that, you can expect the company to rebalance your portfolio every 2-3 months.

The company also believes in a tax optimization strategy.

Before selling a security in your portfolio, FutureAdvisor will consider the tax implications of doing so.

Once your portfolio is appropriately balanced, the company will evaluate things like capital gains and tax implications to try to reduce the taxes on securities.

One of the variables that the company includes in its investing algorithm is the fact that realized short-term capital gains cannot exceed 5% of the position value or $200, whichever comes first.

There are some specific scenarios where the algorithm will override this variable.

But generally speaking, FutureAdvisor will do what it can to reduce your tax burden.

Similarly, the company is also a proponent of tax-loss harvesting.

They will check your holdings, searching for positions with a minimum balance of $500 and 1.5% in taxable, harvestable losses.

If the algorithm came across one of these positions, it would sell the taxable position with unrealized losses and then buy a similar asset fund within the same asset class.

Any losses realized during tax-loss harvesting transactions become a writeoff at the end of the year to offset gains.

How Much Does FutureAdvisor Cost?

The cost of working with the company depends on which of its services you intend to use.

You can open a free account, which provides you with access to a portfolio analysis service.

This could be particularly useful for millennials who already have some investments and are looking for a bit more account management and guidance.

Unfortunately, the rise in robo-advisors has also lead to young investors throwing money into an account without asking questions or considering investment goals.

Certified financial planner Nick Holeman recently told CNBC that there’s no such thing as a millennial portfolio.

He said that “millennials need to focus on building diversified portfolios with low-cost investment fees.”

The article continued to say that millennials “should invest at the right level of risk, taking on more risk for long-term goals and less risk for the short-term, such as a down payment.”

FutureAdvisor’s free services could provide you with the analysis tools needed to do so.

FutureAdvisor also has a premium account available for subscription.

Paying for this premium service provides you with account management.

The premium management fee is 0.5% of the assets that the company manages directly.

For instance, if you have an employer-issued 401(k) that you cannot trade in with FutureAdvisor, the company won’t count this as part of your portfolio management fee.

Unlike some firms, which charge annual fees, FutureAdvisor charges fees quarterly.

You’ll end up paying 0.125% of all directly-managed assets each quarter.

You’ll begin paying for premium services the month after initially funding your account.

The company also says that it seeks to deduct the management fees from non-tax sheltered accounts whenever it can do so.

There are a few other fees you may have to pay if you shift to FutureAdvisor.

You may incur some trading commissions when first rebalancing your portfolio.

However, the company only uses commission-free ETFs.

This means that you likely won’t have to pay trading commissions when rebalancing in the future.

If you rebalance into a TD Ameritrade portfolio, you’ll have to pay transaction fees of $9.99 per ETF or stock trade.

The maximum that you can pay is $24.

If you rebalance into a Fidelity Investments portfolio, you’ll pay $7.95 per ETF or stock trade, although the maximum is a bit higher at $50.

Lastly, you can expect to pay fees to close your account balance at your previous brokerage.

Typically, mutual fund companies and brokerages charge between $50 and $100 to transfer funds.

If you have a Vanguard, Fidelity, or TD Ameritrade account, you won’t have to pay these fees.

Getting Started With FutureAdvisor

If you’re ready to start with FutureAdvisor, you’ll first need to create a login and password.

Then, you’ll enter personal information, such as your:

- Name

- Address

- Social Security Number or Tax Identification Number

- Personal banking information

- Information about the mutual funds and brokerage accounts that you would like to transfer

You must be a citizen of the United States or a legal resident to sign up for this service.

You also must be at least 18 years old.

After providing this information, you’ll create a questionnaire regarding risk.

You’ll answer questions about your reasons for saving and how risky you would like to be.

This allows FutureAdvisor to determine the best asset allocation for you.

If you don’t have an investment account to transfer, it’s okay.

You can still open a Roth IRA, traditional IRA, SEP IRA, or taxable account.

Taxable accounts allow you to invest in things like mutual funds, bonds, and the stock market.

You’ll then pay taxes on the investment income that you earn as a result of market gains.

However, no matter which option you choose, you should be prepared to fund a minimum balance of $5,000.

FutureAdvisor will do the rest.

You do not need to liquidate your previous accounts.

The company completes the necessary paperwork to consolidate your old accounts into a Fidelity or TD Ameritrade account.

Start Investing Today

If you’re self-employed or considering working as a freelancer, you’ll need to get creative when building your retirement accounts.

You won’t have access to a 401(k), a plan that’s only available for employees of a company.

So, you need to be particularly strategic when it comes to managing your investment portfolio.

Using an app like FutureAdvisor could help steer you in the right direction.

You won’t have to worry about hands-on portfolio management.

You’ll gain access to FutureAdvisor’s advisor services, and you can trust in the fact that the company is backed by reputable financial institutions like Blackrock, TD Ameritrade, and Fidelity.

The fees are a bit high, but a FutureAdvisor account could still be an excellent choice for those looking to boost their net worth.

Be sure to check out other robo-advisors like Wealthfront, Personal Capital, and Betterment before deciding where to open your investment account.