Getting a bank account has become a routine thing for most Americans. According to The Federal Reserve, more than 81% of all Americans are fully banked, while 13% use banking services more than cash.

However, most people open a personal checking or savings account without knowing that they can make money by opening an account.

Yes, there are banks that pay you to open an account! Use this guide to find the bank that gives the highest bonuses for opening a bank account.

- The Best Banks That Pay You to Open Account (Overview)

- An Overview of Banks that Pay You to Open an Account

- The Best Bank that Pays You to Open a Bank Account at a Glance

- Features to Look for in Banks That Pay You to Open a Bank Account

- Best Bank that Pays You to Open a Bank Account: Our Top 3 Options [Ranked & Reviewed]

- Notable Mentions: Other Banks that Pay to Open a Bank Account to Check Out

- Frequently Asked Questions

- Alternatives to Banks That Pay You to Open Accounts

- Wrapping Up

The Best Banks That Pay You to Open Account (Overview)

We’ve included an overview of our top picks below. For detailed information on each pick, scroll down.

- CitiBank: Our Pick

- Wells Fargo: Runner-Up

- Associated Bank: Also Great

- Chase: Best for a Modest Balance

- Alliant Credit Union: Best for Savings

- Huntington National Bank: Best for Midwesterners

- PNC Bank: Best Digital Tools

- BMO Harris: Best For ATM-Lovers

- SoFi Bank: Best for Fee-Haters

An Overview of Banks that Pay You to Open an Account

Some banks often have money but lack the desired number of customers.

That’s why some of them are willing to give you a cash bonus for opening a new account, whether it’s a personal checking account, savings account, or a new business checking account.

What Is a Bank That Pays You to Open an Account?

Banks that pay you to open an account are financial entities that award sign-up bonuses for new customers looking to open a checking or savings account with them.

Why Are Banks That Pay You to Open an Account Important?

Banks that pay you to open an account are important because account holders can earn a cash bonus by making qualifying direct deposits or maintaining a minimum balance for a given amount of time.

Do I Need a Bank That Pays to Open a Bank Account?

You don’t necessarily need one, but why wouldn’t you use this great opportunity to increase the amount of money in your personal or business checking account?

These bank account bonuses are great for earning interest or spending them on matters that require immediate attention.

The Best Bank that Pays You to Open a Bank Account at a Glance

If you’re looking for the best options on the market, you should consider our top two picks. These banks are the best of the best.

What Is the Best Bank that Pays You to Open a Bank Account?

It’s, without a doubt, Citibank.

They have some of the highest bonuses out there, paired with great infrastructure and a lot of services you can use for your benefit.

What Is the Most Popular Bank that Gives Account Bonuses?

The most popular bank that gives out account opening bonuses is Chase.

This is the biggest, most powerful bank in the United States, and it’s growing even bigger!

Features to Look for in Banks That Pay You to Open a Bank Account

Here are the most important things to consider in a bank that pays you to open an account:

Future Benefits

This factor is more relevant for savings account bonuses.

Usually, the interest rate for accounts qualifying for bonuses is two times lower compared to basic savings accounts. Hence, you’ll earn less money from your savings in the long run.

Convenience

Opening a checking account with a bank that doesn’t have many ATMs near your area isn’t a good idea if you’re someone who uses ATMs frequently.

Opt for a bank that has several ATM machines in your town.

Fees and Taxes

According to a recent Bankrate survey, the average American pays $288 in fees per account within a year. This is a lot of money to pay for maintenance!

Make sure to check for any underwater stones when talking about fees.

User-Friendliness

Banking is becoming more and more digitalized than ever. That’s why it’s important to opt for a bank that offers user-friendly banking apps and online banking tools.

Best Bank that Pays You to Open a Bank Account: Our Top 3 Options [Ranked & Reviewed]

The following banks are the best if you’re looking to get a checking or savings account that pays bonuses.

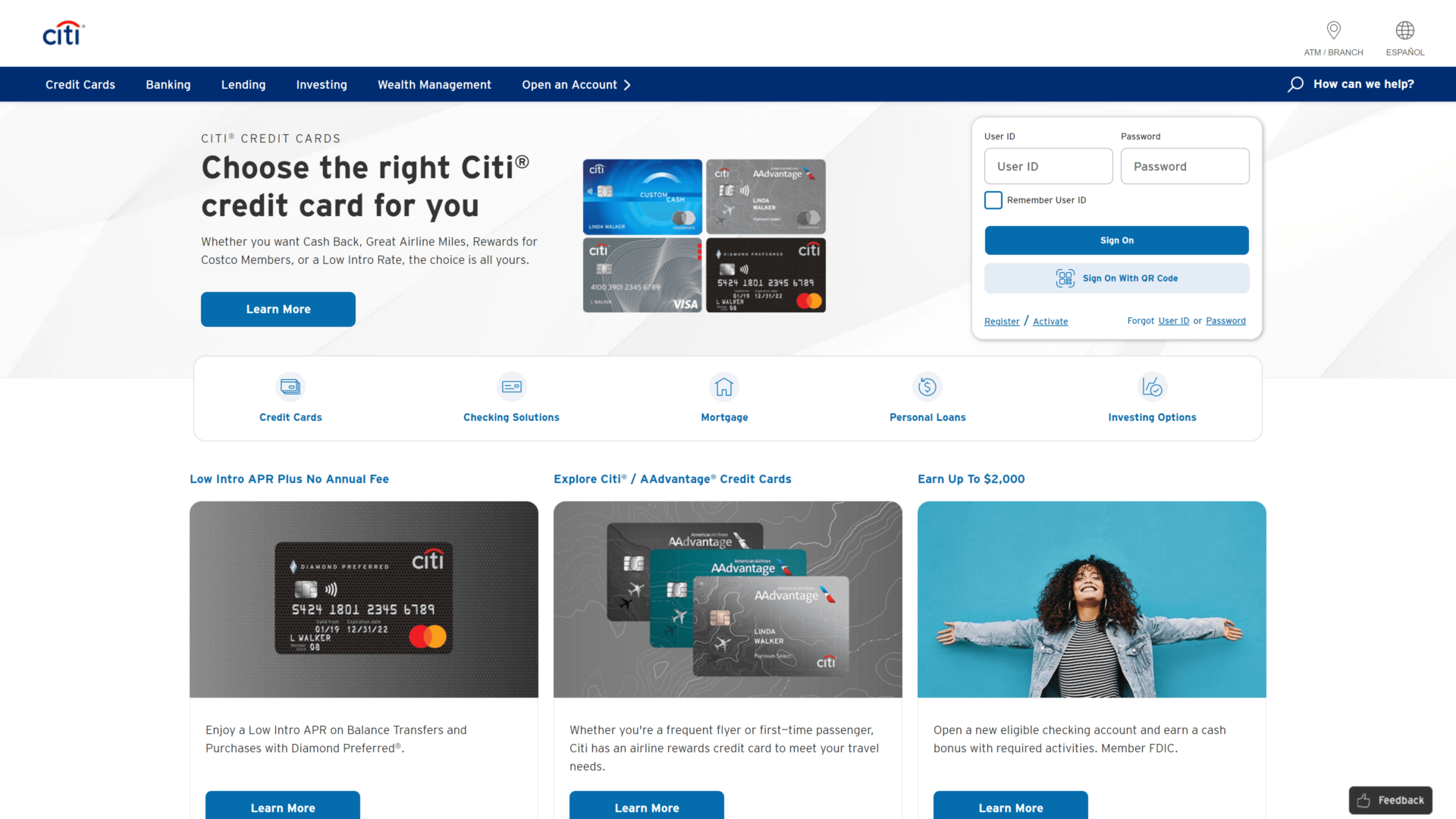

1. Citibank – Our Pick

Citibank is one of the four biggest banks in the United States, with more than $1.4T in deposits at the end of 2022!

With Citibank, you can earn up to $2000 in bonuses if you have enough money to put down the biggest minimum deposit.

Key Features of Citibank

Besides giving up big sums of money as bonuses, Citibank has some key features you can look at before opening an account with them. Here are some of the most important:

- Global Reach: Citibank is a multinational bank with more than 4000 branches in 40 different countries.

- Good Number of ATMs: It has a vast network of ~2300 Citi ATMs and more than 65000 fee-free ATMs all around the world.

- A Ton of Financial Services: Citibank is part of Citigroup, one of the biggest financial ecosystems in the world. This gives them the possibility to provide an enormous amount of services.

- Three CD Account Types: CD accounts are one the most popular among those who want to earn high interest. Citi offers a wider variety of CD accounts compared to other banks.

- Great Digital Experience: Just like any other top bank should do, Citi has an impeccable online banking app for both iOS and Android users.

Pros of CitiGroup

- Competitive Yields on Savings Accounts: Those users who are eligible for Citi Accelerate Savings get a competitive yield, practically the same as you would get at online banks.

- Assorted Savings and Checking Packages: Citibank has over six checking account types, one of which included the Citi Priority Account, and three types of Savings accounts with great interest rates for each of them.

- Unique Advantages for Traveling: With branches and ATMs placed all around the world, Citibank account holders can access their funds or talk to a banker about their transactions in more than 40 countries.

Cons of CitiGroup

- Small Number of US Branches: While the number of worldwide Citibank branches is over 4000, the number of US branches is just a little over 600.

- Costly Monthly Fees: If you are unable to meet the requirements to waive the fees for savings and checking accounts, you’ll have to put up with some high monthly fees.

- Some Services Unavailable in Some States: The best savings account at Citibank, Citi Accelerate, isn’t present in states like New York, Illinois, and Virginia. In these states, the APYs are lower (don’t confuse them with APRs).

CitiGroup Pricing & Bonuses

- Fees for Savings: The fees you’ll have to pay for a savings account with Citibank can range from $5 to $25 for accounts that are not linked to a checking account.

- Fees for Checking: For checking accounts, Citibank offers a wider variety of fees. The monthly fees for a checking account at Citibank vary from $0 to $30 per month.

- Citibank Bonuses: You can earn up to $2000 in cash bonuses by opening a checking account at Citibank. However, your checking account bonus will depend on how much money you’ll deposit. For instance, when making a minimum deposit of $10000 and maintaining the minimum balance can earn you $200.

Conclusion: Should You Choose Citibank?

Citibank is an excellent option for those traveling a lot.

The bank has a worldwide presence, with branches in 40 different countries all around the world. They provide a lot of financial products and services, pairing them with high bonuses.

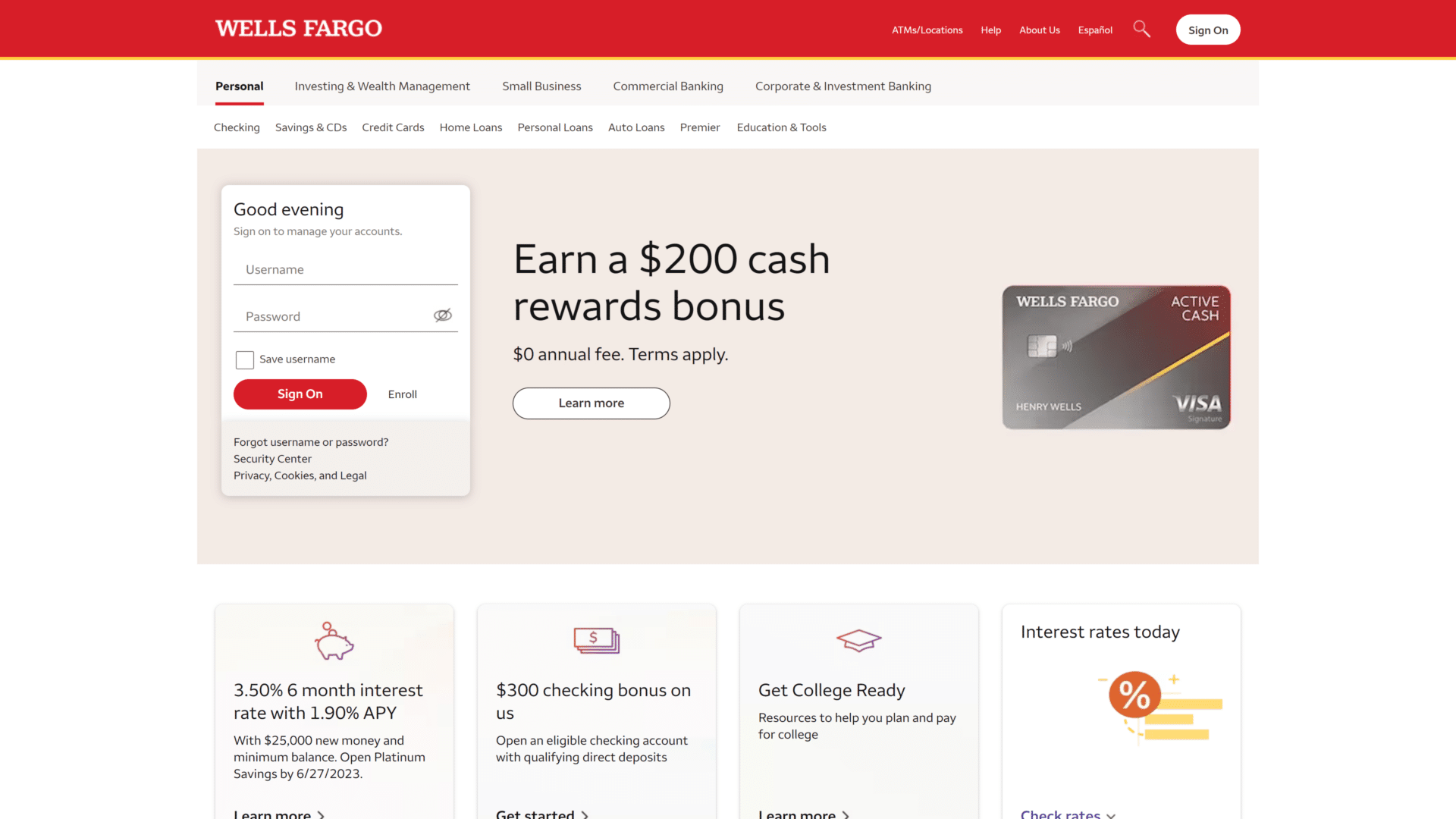

2. Wells Fargo – Runner-Up

Wells Fargo is one of the biggest banks in the United States, with more than 4800 branches in 40 different states.

With Wells Fargo, you can take advantage of their highly praised digital banking or their ground infrastructure.

Key Features of Wells Fargo

Here are some of the key features of Wells Fargo you should take a look at.

- A Large Number of Branches: Many people often use brick-and-mortar banks to cover their financial needs. If you are one of those people, Wells Fargo is perfect for you.

- Full Range of Services: It’s hard to choose one bank for all the financial services you need. Wells Fargo offers a full range of banking services, from bank accounts to business loans.

- No More NSF Fees: Wells Fargo is one of the first American banks to eliminate non-sufficient funds fees. Also, some other fees imposed by the bank, especially those on checking accounts, can be easily avoided.

- Customer Service: Not many understand how banks work and how to use some features of their digital banking. That’s why Wells Fargo’s customer service is available 24/7, even on Twitter and Facebook.

- Innovative Approach: People who use Mint, QuickBooks, or TurboTax should choose Wells Fargo. The bank has partnered with Intuit to provide a highly secure connection with these products.

Pros of Wells Fargo

Here are some of the most important benefits of using Wells Fargo

- High Bonuses: At Wells Fargo, you can earn up to $2500 for opening a new Wells Fargo Premier checking account. This is the highest bonus out there.

- Early Direct Deposit: Wells Fargo is one of the few banks that offer early direct deposits for its customers. This is a convenient way of getting your funds up to two business days earlier.

- Digital Leader: Wells Fargo’s mobile app is the highest-rated among nationwide banks. It offers a ton of different financial instruments like depositing checks, sending and receiving money via Zelle, and a lot more.

Cons of Wells Fargo

- Small Interest Rates: Wells Fargo doesn’t compete with interest rates offered by other banks. This is caused by the fact that account APYs tend to get lower at traditional banks like Wells Fargo.

- History of Scandals: Wells Fargo paid more than $100M in fees for illegal practices and violations of different financial and civil laws.

- Out-of-network ATM Fees: If you’re a big ATM guy, Wells Fargo isn’t the best option for you, as it has high out-of-network ATM fees.

Wells Fargo Pricing & Bonuses

If you want to consider Wells Fargo as your bank, here is the pricing list and the amount of money you’ll receive as bonuses:

- Fees for Savings: You can choose from two savings account types: Way2Save and Platinum Savings. For Way2Save, you’ll pay a $5 monthly maintenance fee. For Platinum Savings, you’ll pay a $12 monthly service fee.

- Fees for Checking: At Wells Fargo, you can choose from three different checking account types: Everyday Checking, Portfolio, and Clear Access Banking. All three have the same minimum opening deposit of $25 and fees of $10, $25, and $5, respectively.

- Wells Fargo Bonuses: Besides the $2500 bonus, which requires some investments, you can only earn up to $300 in bank bonuses if you open a new checking account with Wells Fargo. For a savings account, there are no bonuses in place at this bank.

Conclusion: Should You Choose Wells Fargo?

Wells Fargo is an excellent choice for people who want a full range of financial services. It is the third biggest bank in the US, with a lot of branches and ATMs in place.

Also, it pays high bonuses, especially for those who are willing to transfer all their money from another bank to Wells Fargo.

3. Associated Bank – Also Great

From an ROI point of view, Associated Bank account bonuses are the best in the industry. They are high, easy to earn, and especially convenient for those using direct deposits.

Key Features of Associated Bank

- Great Digital Experience: Associated Bank’s app is highly rated among iPhone and Android users. The app allows you to make mobile deposits, make P2P transactions and pay your bills via Bill Pay.

- Convenience: You can check your account balance and transactions, make transfers, and report lost or stolen debit cards, even on Sundays or holidays.

- Part of MoneyPass: If you need an ATM to complete your banking transactions, Associated Bank is one of the best options for you. While the bank has an extensive network of its ATMs, it is also a part of the MoneyPass ATM network, providing fee-free access to ~40000 ATMs.

- Best ROI: Compared to other banks, where you must have a high qualifying direct deposit or an enormous minimum balance to meet the bonus requirements, at Associated Bank, you can have only $10000 to receive $500.

Pros of Associated Bank

- Low Minimum Balance Time Requirements: At Associated Bank, you must keep your minimum balance for only 3o days to get the bonus.

- Free Checking Account: For one of their most popular checking accounts, you won’t have to pay anything.

- Highly Rated App: While they don’t have many digital banking tools, their app is one of the best in the industry.

Cons of Associated Bank

- Only Available in Some States: Associated Bank is present in only 15 states.

- Small Interest Rates: The bank can offer only up to 4% APY for a savings account.

- Bonus Requirements: Getting a direct deposit is required to be eligible for the bonus.

Associated Bank Pricing & Bonuses

- Savings and Checkings Fees: For savings, there is a $6 maintenance fee and $6 if you get over the withdrawal limit. For checking, there are no maintenance fees, but there is a $32 overdraft fee.

- Associated Bank Bonuses: You can earn up to $500 by meeting the minimum balance requirements.

Conclusion: Should You Choose Associated Bank?

If you are a resident of Wisconsin, Minnesota, Illinois, Missouri, Ohio, Indiana, Michigan, or Kansas, you should choose Associated Bank.

It has the highest ROI for the best bank bonuses out there, meaning that you can earn a ton of money without using a lot of it.

Notable Mentions: Other Banks that Pay to Open a Bank Account to Check Out

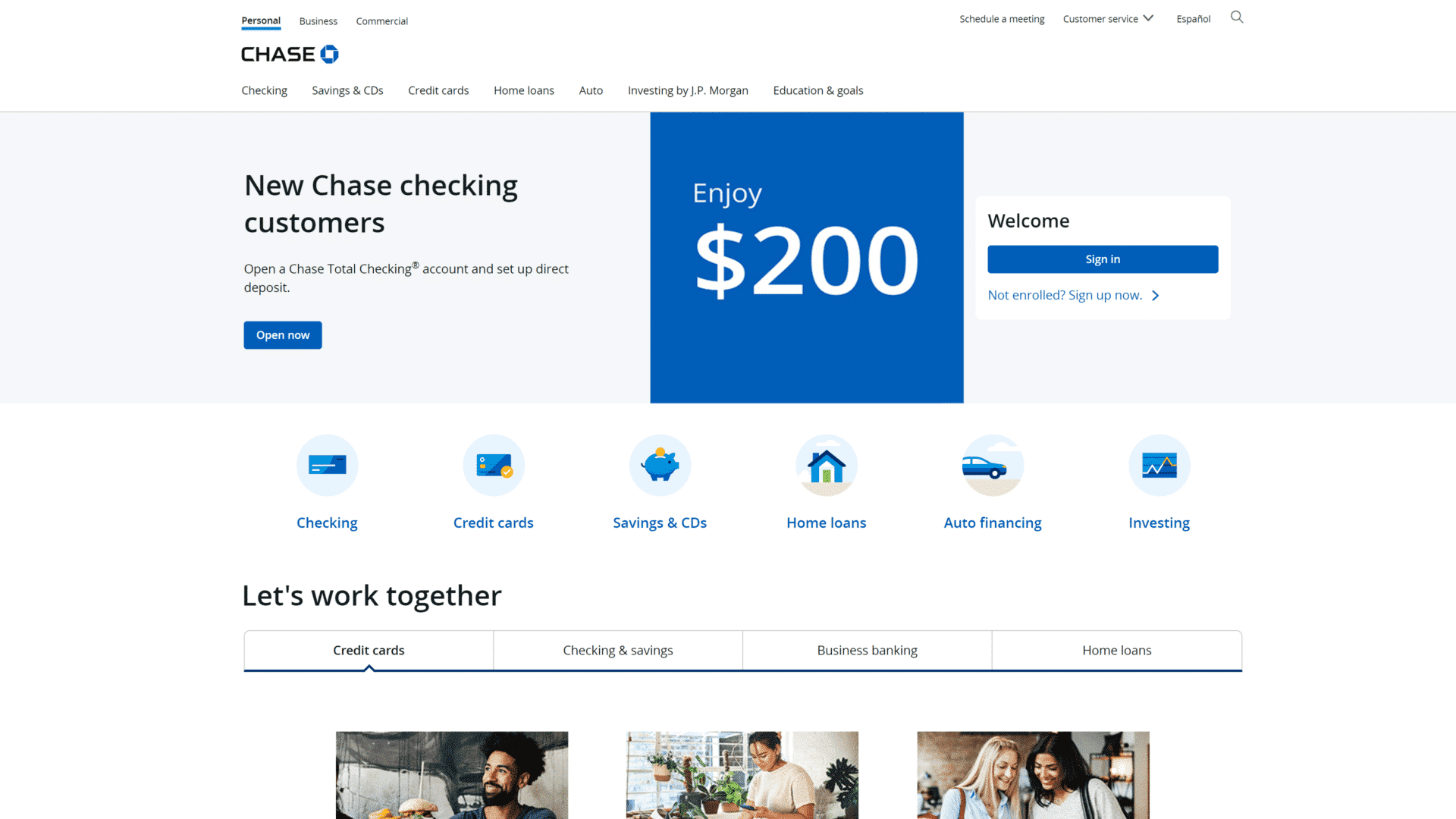

4. Chase – Best for a Modest Balance

Chase is the biggest bank in the United States, surpassing Bank of America by a whopping $100B in market capitalization, according to Statista.

The bank is expanding its range of products and customer reach. At the beginning of 2023, Chase bought First Republic Bank’s deposits and renamed their ~90 branches into Chase Bank.

Why is Chase a Great Option?

If you are looking for the most present bank in the industry, Chase is the one. With more than 4900 branches and 16000 ATMs, the bank is present in nearly any state.

Chase’s app is adaptable and lets you send money to anyone, pay online bills, and budget your sources.

Drawbacks to Consider at Chase

First of all, Chase doesn’t have the highest yields out there. Their basic account, Chase Savings, offers only 0.01% APY.

Also, there are a lot of fees involved with using Chase. Some of them are not waivable.

Chase Pricing & Bonuses

You should consider the following fees and compare them with the bonuses.

- Savings Fees: For the basic account, you’ll pay a monthly fee of $5, while for the Premiere Savings account, you’ll pay $25.

- Checking Fees: Chase has eight different checking account types. Two of them have fixed fees of $12 and $4.75.

- Bonuses: Chase has $100 and $200 bonuses on some types of checking accounts. For example, you can earn $200 by opening a new Total checking account and making a qualifying direct deposit.

5. Alliant Credit Union: Best for Savings

Alliant Credit Union is an online credit union based in Chicago. It offers highly competitive APYs and low fees on a wide range of banking products, including business credits.

With Alliant, you don’t have to work in a certain field or company. You pay a one-time $5 donation, and you are in.

Why is Alliant Credit Union a Great Option?

Alliant offers some of the highest APYs on the market, beating banks like Bank of America, Chase, and Wells Fargo.

Also, the credit union has a wide ATM network with varied options. You can access nearly 80000 ATMs free of charge.

Drawbacks To Consider at ALLIANT cREDIT uNION

With Alliant Credit Union, you’ll have to complete all your transactions through online banking. For some, this is a plus, but many Americans want to open their checking account in person.

Alliant Credit Union Pricing & Bonuses

- Savings Fees: If you are not enrolled for e-statements and want to receive paper statements, you’ll have to pay $1 per month.

- Checking Fees: There are no fees or overdrafts if you open a checking account with them.

- Bonuses: You can earn up to $200 if you open an Ultimate Opportunity Savings Account and make monthly direct deposits worth $100. This only works with new customers.

6. Huntington National Bank: Best for Midwesterners

If you live in the Midwest or South, Huntington National Bank is your choice. You’ll have access to a wide range of products and features, digitalized services, and much more.

While Huntington National Bank is a regional bank, it is fairly big, with more than $170B worth of assets, according to USNews.Com.

Why Is Huntington National Bank a Great Option?

Huntington National Bank has more than 1000 branches and 1700 ATMs. They offer a wide range of products, from checking accounts to money market accounts.

Huntington provides nearly 24/7 services with All Day Deposits. It extends the banking day until midnight for deposits made through an ATM or mobile app.

Drawbacks to Consider at Huntington National Bank

They offer small interest rates on CDs and savings accounts. Also, if you want to earn some interest on money market accounts, you should know that their minimum balance to earn interest is steep.

While the bank offers a $50 overdraft buffer, if you get over that buffer, the overdrafts are costly.

Huntington National Bank Pricing & Bonuses

- Savings Fees: The Huntington Relationship Savings account charges a $10 monthly fee if you can’t keep an average daily balance of at least $2500. For their Premium Savings, there is a $4 maintenance fee.

- Checking Fees: Huntington Asterisk-Free checking account has no fees. Huntington Perks Checking account has a $10 maintenance fee that can be easily waived. The Huntington Platinum Perks Checking account has a $25 maintenance fee.

- Bonuses: You can earn up to $600 by opening a checking account within the Huntington National Bank ecosystem. For opening a Perks Checking account, you get $400, and for opening a Platinum Perks checking account, you get $600. Of course, you should complete the requirements to get the bonuses.

7. PNC Bank: Best Digital Tools

According to Insider Intelligence, PNC Bank is the sixth-largest bank in the United States, with more than $553B worth of assets.

This is a solid choice for those looking for a strong combination of digital tools and brick-and-mortar branches.

Why is PNC Bank a Great Option?

PNC Bank has the best digital banking tools out there. It offers the Virtual Wallet, which is a combination of everyday checking accounts, long-term savings, and short-term planning.

These digital advantages are combined with a strong presence in the real world, with over 60000 free ATMs and 2600 branches.

Drawbacks to Consider at PNC Bank

PNC Bank had a number of problems after the fall of Silicon Valley Bank. Their stock went downwards, plummeting more than ~20%!

Also, their overdraft fees are over the roof, and their high-yield savings accounts aren’t available in all states.

PNC Bank Pricing & Bonuses

- Savings Fees: No fees for savings accounts.

- Checking Fees: There is a $7 monthly maintenance that can be easily avoided.

- Bonuses: You can either earn $400 or $200 with PNC Bank. To earn $400, you have to open a Virtual Wallet Checking Pro and complete the qualifying direct deposit requirements. To earn $200, you need to open a Virtual Wallet Checking Pro and meet the requirements in your location.

8. BMO Harris – Best for Personal Banking

BMO Harris is a US subsidiary of Canada’s Bank of Montreal. The bank provides financial services for more than 12 million customers from all around the world.

In terms of bonuses, you can earn up to $500 from BMO Harris. The bank has more than 500 branches and 45000 ATMs.

Why is BMO Harris a Great Option?

BMO Harris offers a full pack of personal banking features and services. They are combined with a decent brick-and-mortar presence and a lot of checking and savings options for personal usage and loans and credits for businesses.

Also, there are no fees for checking accounts with online statements. So, if you don’t want a paper statement, you won’t have to pay anything.

Drawbacks to Consider at BMO Harris

They don’t have big interest rates for a basic savings account. These, paired with steep overdraft fees, can turn some of you away.

Also, they are present only in 8 states with real-world branches.

BMO Harris Pricing & Bonuses

- Savings Fees: There are no savings account fees.

- Checking Fees: Paper statements cost $3, the same as out-of-network ATM usage. Overdrafts cost $15 for every transaction.

- Bonus: You can get up to $500 at BMO Harris. However, it depends on how much money in direct deposits you’ll use in 90 days.

9. SoFi Bank – Best for Fee-Haters

SoFi is a fairly new bank that gained its bank charter in 2022. In the past, the bank was known for providing student loans and refinancing services.

The bank is best for those who want to earn high interest on their savings, as the bank has high APYs for all types of savings accounts.

Why is SoFi Bank a Great Option?

SoFi is the best bank for those living close to SoFi stadium. They can get enormous discounts on merchandise and food there.

Also, the company offers a wide range of interesting features, including early direct deposits and cash backs at some retailers.

Drawbacks to Consider at SoFi Bank

There are no brick-and-mortar locations for SoFi Bank. This is a serious drawback for those who can’t wholeheartedly trust online banks.

Cash deposits are a big no-no if you want to use SoFi, as they are only available through third parties and have high fees.

SoFi Bank Pricing & Bonuses

- Savings and Checking Fees: Besides the fees you must pay at cash deposits, SoFi doesn’t have other fees for either savings or checking

- Bonuses: You can earn up to $250 by opening a Checking and Savings account. However, you’ll need to make a direct deposit of $5000 to earn $250.

Frequently Asked Questions

Here are the answers to some of the most frequently asked questions about bank account bonuses:

Are Bank Bonuses Taxed?

Yes, bank bonus offers are taxed.

The IRS sees a bank bonus as revenue for the person that receives it. Keep it in mind when you file your next tax report if you receive a money market account bonus or any other type of cash bonus.

Why Do Banks Offer a Bonus for Opening an Account?

It’s a marketing tactic.

According to the Federal Reserve, there are approximately 4448 insured banks in the United States. The industry is highly competitive, and the banks are fighting for each client.

Alternatives to Banks That Pay You to Open Accounts

If you enjoyed this article, be sure to consider reading about other opportunities for earning bonuses.

Learn more about companies and applications that will pay you to either sign up or do something fun:

- Sign up and get Free Money: There are apps out there paying great rewards for those who are willing to sign up. These sign-up bonuses can come in various forms, such as gift cards, discounts, and even cash rewards.

- Companies that Pay for Ideas: Big companies are always searching for new ideas to implement in their products. If you are creative and have great ideas to share, you can earn from $100 up to millions of dollars!

- Magazines that Pay for Short Stories: Are you an occasional writer with lots of original stories to share? Well, you can get some cash rewards from magazines looking for fresh authors and texts.

Wrapping Up

If you’re looking to open a new checking account and want to get a bonus, you should choose Citibank. It combines great financial tools with high bank bonuses and interesting perks.

Alternatively, you can go for Wells Fargo if you prefer a more traditional banking approach. It’s among the most popular options out there.

Did you find this guide helpful? If so, be sure to share it with others who are looking to open a new bank account.

And if you have any questions, leave them in the comments section below, and we’ll get back to you as soon as possible.