Rarely are people excited to discuss personal finances.

First of all, finance means numbers and calculations.

Second, it’s personal and requires you to question your spending, saving, and overall money habits.

These are two things most of us would rather not deal with, so monthly budgets are glossed over, bank letters remain unopened, and billing statements go straight to autopay.

But thankfully, we live in a time where there’s an app for everything, and many are dedicated to money management.

Two popular personal finance apps are Personal Capital and Mint.

Both are free, sync all your finances on a single platform, and offer much more than just bill payments.

However, you only need so many financial apps.

The goal is to simplify your finances, and by breaking down each app and its different features, this post will help you discover which one is worth your download.

The Basics of Personal Capital

Personal Capital describes itself as a “smart way to track and manage your financial life.”

It’s smart in that some of the industry’s best and brightest sit on the board and in that it offers help from “robo-advisors.”

It provides individuals with the best investment management services through a combination of precise algorithms from “robo-advisors” and industry experience from human financial advisors.

Personal Capital’s offerings are split into two: free financial tracking tools and paid financial advisory services.

Free accounts are open to everyone and allow you to link to bank accounts, credit cards, loans, and investment accounts.

This gives users a comprehensive view of their finances and access to a number of tools: a retirement planning tool, a mutual fund fee analyzer, an asset allocation target, an investment checkup, and more.

Paid managed accounts, on the other hand, come in three tiers, depending on the total amount of assets.

(The first tier starts at $100,000, the second starts at $200,000, and the third tier is for anything greater than $1 million.)

Each tier offers a unique combination of services — everything ranging from college savings to stocks and bonds — and a corresponding annual management fee, which is usually a percentage of the total amount of assets.

Given the required minimums, paid accounts are obviously intended for those with some savings to invest.

If you’re interested in this service, the Personal Capital app provides access to seasoned advisors and round-the-clock-support, while still giving individuals an overview of their investments in a simple manner.

To date, the company has helped 2 million people plan their finances, and managed $10 billion worth of assets.

Everything You Need to Know About Mint

As one of the first in the fintech space, Mint is known as “the free money management and financial tracker app that helps you get ahead and stay ahead.”

Although the app was acquired by Intuit (the company behind Quicken and Turbotax) in 2006, it still stays true to its founding purpose — to help users stay financially healthy and within budget.

Mint offers just one type of account to all its users, which is a completely free service with a full set of personal budgeting features.

Users simply enter their information for banks, credit and debit cards, PayPal, and almost any U.S. financial institution.

From there, Mint automatically downloads several months of data you’ve input to these financial accounts to give users an all-encompassing look at their finances.

Mint starts out with the standard categories — overview, transactions, budgets, goals, trends, investments, and ways to save — and even offers a free credit score and suggested budget based on past spending patterns.

These are all customizable.

The other main feature of the app is the ability to keep track of upcoming bills, loans, investments, and ATM transactions, as well as setup alerts for any payments or financial goal updates.

Let’s take a look at the features of Personal Capital vs. Mint.

Mobile and Desktop Access: Personal Capital vs. Mint

These days, brands really need to be on mobile apps as well as web platforms to be convenient.

Personal Capital has a mobile app available for download on the iPhone, iPad, Apple Watch, and Android.

The app offers everything the desktop platform has, and both versions are free.

Mint is also available through both mobile and desktop.

The mobile app works on the iPhone, iPad, and Android.

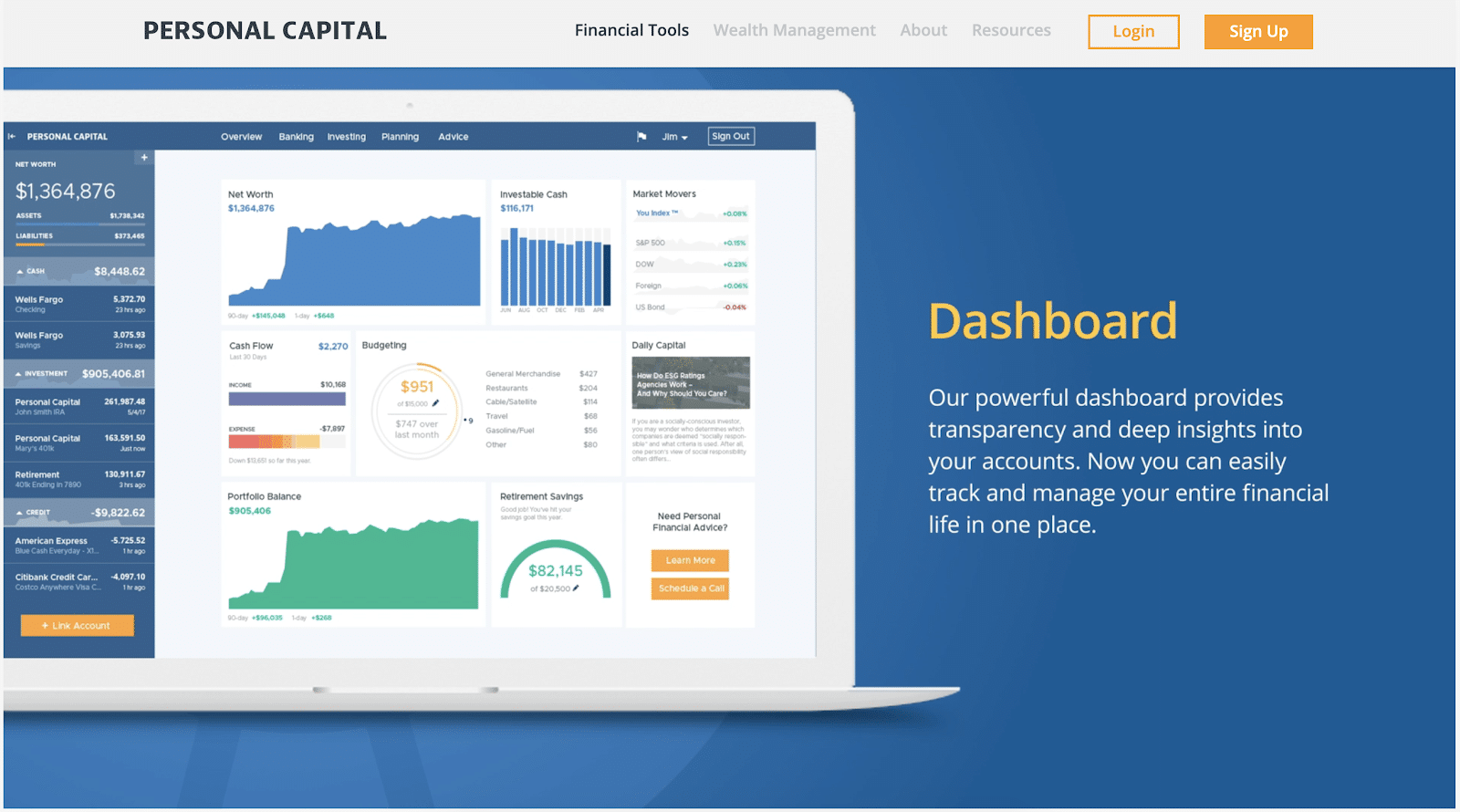

Dashboard Interface: Personal Capital vs. Mint

When you open the apps, you’ll notice each one has a unique look and feel.

Personal Capital is obviously more focused on investing with an assortment of graphs and charts, and a solid blue menu and sidebar.

It presents your finances in a very factual format, breaking it down into cash flow, net worth, and your portfolio balance.

That being said, the dashboard is able to present all this information in a very clear and user-friendly manner.

Mint is what you’d expect from an easy-to-use app — a lot of white space, playful sky blue buttons, and simplified charts.

Most of the information is focused on your accounts and spending patterns, with a generous sponsor space for its suggested offers.

Budget Tracking: Personal Capital vs. Mint

Budgeting is the main reason most people download a personal finance app and is, therefore, the most important feature to note in both Personal Capital and Mint.

Personal Capital offers a cash-flow style of budgeting that focuses on monthly income and expenses.

Once you set a monthly budget, the app will give you an overall report based on your spending.

This is a simplified look at budgeting but really all one needs — ultimately, you just want to know if you’re within your budget.

Mint, however, gives a little more detail and prioritizes its budgeting tools.

It allows you to build your budget from the ground up, setting up sub-categories for each month (i.e., utilities, rent, groceries), so you know exactly where your money goes.

Mint knows that bills make up the bulk of your budget.

For this reason, they can connect with an unlimited number of billed accounts (i.e., credit cards, loans, utilities) and notify you of any upcoming payment due dates.

If your bank account is linked, you can also use Mint to pay the bills according to an automated schedule.

Investment Tools: Personal Capital vs. Mint

Both apps offer users the option to link to and track your investments.

This is where Personal Capital shines, as it was created as an investment app.

You simply input your investment information, and Personal Capital keeps track of your portfolio, analyzes its allocations and risks, and offers some suggestions.

These calculations are almost impossible to do on your own, so they’re a welcome addition for the highly invested and quite an advanced feature in a free app.

Personal Capital’s investment platform includes a 401(k) Fund Allocation and a Retirement Planner, which both help you analyze your plans and stay on track for your future retirement goals.

In Mint’s case, however, investments are more of an add-on feature.

It tries, with some simple charts and numbers, but really only helps to aggregate your total investment and see how it adds to your net worth.

Ready, Set, Save

Both Personal Capital and Mint have been around for more than a decade, and have grown a solid user base for their free accounts.

It’s easy to see why — if you consolidate all your accounts onto one platform, it’s simpler to review and take care of your finances.

That, however, is where the similarities end.

Personal Capital is more of an investing app and provides a robust set of features to do so.

Mint, on the other hand, has always been a budgeting app and focuses on delivering the tools to keep yours in check.

Which one you download really depends on what kind of financial planning you want to do.

Are you trying to reign in your spending habits and increase your credit score?

Choose Mint.

Have you saved a bit and are now interested in investing those funds?

Try Personal Capital.

The two services are highly specialized and highly regarded, and either will be a great addition to your financial toolkit.

I’m a big fan of Personal Capital and Mint, but I’m also a big fan of tracking my own finances. I use both Personal Capital and Mint to track my finances, but I also use a few other finance apps to track different