If you’re short on cash and need an urgent boost to help until your next paycheck, cash advance apps like EarnIn can grant you a convenient loan. However, with so many options to choose from, it can be difficult to figure out which is the best for you.

We’ll go over the best cash advance alternatives to EarnIn and help you decide which option fits your needs the best.

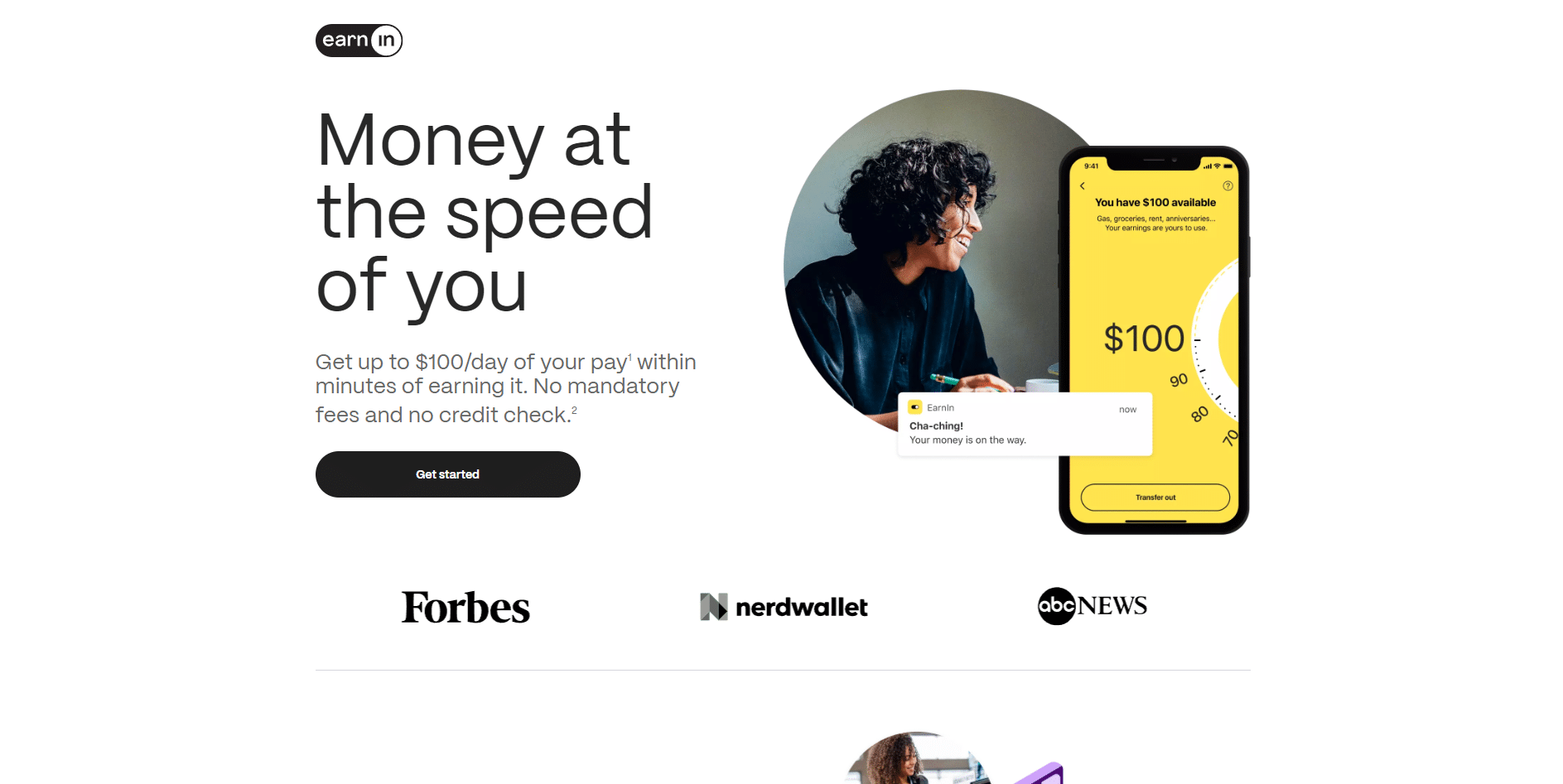

An Overview of EarnIn

EarnIn is a popular cash advance app available in the United States. It offers interest-free cash advances worth up to $750 per pay period.

Where Does EarnIn Excel?

EarnIn’s cash advances are among the highest in the industry. It typically doesn’t take more than three workdays to process them, and they don’t have any hidden fees that you wouldn’t expect. Likewise, it’s free to use, with no regular subscription fees. All these factors make EarnIn one of the most popular cash advance apps of its kind.

Where Does EarnIn Fall Short?

For all its upsides, EarnIn has several flaws that may serve as a dealbreaker for many. Despite the $750 advance limit per pay period, you can’t borrow more than $100 per day. Instant transfers may be costly, with a fee running between $0.99 and $3.99, depending on the size of the cash advance. Also, it’s not available for users outside of the US.

Best Cash Advance Apps Like EarnIn at a Glance

- Dave ExtraCash: Best Overall

- Albert Instant: Best Free Option

- Cash App Borrow: Best for Short-Term Loans

- Varo Advance: Best for Instant Transfers

- Current Overdrive: Best for Longer Loan Terms

- Empower Cash Advance: Best Mobile Service

- Revolut Early Salary: Best for International Users

- Chime SpotMe: Best for Overdraft Coverage

- Brigit Instant Cash: Best Budgeting and Spending Insight Tools

Editor’s Choice: Our Top Picks Overall

Before going into a detailed overview of each alternative, we’ll briefly describe the top options and their benefits.

What is the Best Alternative to EarnIn?

Dave ExtraCash is the best overall option. It lets users borrow a cash loan worth up to $500, with a membership fee of only $1 per month. It also includes nifty extra goodies, such as the Side Hustles feature, which allows you to search and apply for jobs straight from the app.

What is the Best Free EarnIn Alternative?

Among the free options, Albert Instant stands out as the best. It’s a part of Albert, an all-in-one financial app. It also doesn’t come with any interest or fees unless you opt for the instant loan option.

The Best EarnIn Alternatives in 2023

Here is a list of the nine best apps like EarnIn that you can find, along with a detailed look into their characteristics, pros and cons, and best use cases.

1. Dave ExtraCash

- Good: Cash loans worth up to $500 are transferable in 2-3 days, with no interest charges.

- Bad: It requires a $1 monthly membership fee.

- When to choose this EarnIn alternative: It’s the best overall alternative, especially if you need a heftier loan.

As one of the tools included in Dave, an all-in-one financial management app for mobile platforms, Dave ExtraCash lets you open a savings account linked to your bank.

It allows you to borrow an advance worth up to $500 up to your next payday, with no interest and no credit history checks. Still, having a total monthly deposit of $1,000 or more and a 60-day account history of positive balances improves your eligibility.

Why Is Dave ExtraCash a Great Option?

Dave ExtraCash comes with access to several other nifty features, such as budgeting tools or alerts to help you avoid overdraft fees. The Side Hustle feature also lets you find gigs to work on straight from the app.

Drawbacks to Dave

There’s a $1 monthly subscription fee — although this shouldn’t present a huge problem to most users. Withdrawals typically take 2-3 workdays to be processed, while instant cash advances cost between $2.49 and $5.99, depending on their size.

2. Albert Instant

- Good: No membership fee or interest charges on cash advances.

- Bad: The premium plan needs to be manually unsubscribed from.

- When to choose this EarnIn alternative: It’s the best all-in-one financial management solution that you can use completely free.

Albert is another all-in-one financial management app that offers a collection of tools to help you with your finances. The Albert Instant component allows interest-free cash advances up to $250.

During a single pay period, Albert Instant lets you make up to three cash advances totaling $250. As with EarnIn or Dave ExtraCash, the cash advance is repaid on your next payday.

Why Is Albert Instant a Great Option?

Albert Instant is completely free to use unless you want to opt for an instant loan to get the money within minutes or if you wish to use the Albert Genius premium service. The Albert Cash account comes with early direct deposit and cashback rewards.

Drawbacks to Albert Instant

Most new users forget to notice that they’re signed on to the Albert Genius premium plan by default — to proceed without paying a $14.99 monthly fee, you have to manually unsubscribe. Also, the 2-3 day wait for a cash deposit might be too long.

3. Cash App Borrow

- Good: Instant processing time, repayable within four weeks.

- Bad: Flat 5% fee for a loan, with another 1.25% per overdue week.

- When to choose this EarnIn alternative: Cash App Borrow is primarily designed for smaller, short-term loans.

Cash App, a popular instant cash transfer app available in the US and UK, also offers a cash advance service. However, it’s limited only to certain US states.

Additionally, it includes a direct deposit service option that lets your employer pay out your salary two days early.

Why Is Cash App Borrow a Great Option?

The app is completely free, with no monthly fees, allowing loans between $20 and $200. The four-week deadline is flexible, letting you pay your loan back whenever it suits you, although there’s an extra interest per overdue week.

Drawbacks to Cash App Borrow

The 5% interest fee per loan is quite steep, especially when taking the extra 1.25% per overdue week into account. Defaulting on the loan could cause Cash App to report you to the tax authorities, decreasing your credit score.

4. Varo Advance

- Good: Instant processing with a flexible repayment deadline.

- Bad: Maximum $100 loan, with fees for advances over $20.

- When to choose this EarnIn alternative: If you need a cash advance app for small, instant loans, Varo is a great option.

While most cash advance apps are a service, not a bank, Varo is a full-fledged digital bank with millions of clients. Varo Advance is their cash advance service, accessible to clients with qualifying direct deposits of at least $1,000 in the Varo checking account.

As part of the package, you also receive Varo’s own Visa debit card.

Why Is Varo Advance a Great Option?

A Varo account gives you paycheck access two days early. Moreover, you can pick your own return deadline anywhere between 15 and 30 days after the loan. There are no monthly fees to pay — a Varo bank account is completely free.

Drawbacks to Varo Advance

Each advance over $20 will come with a progressively larger interest fee. The $100 advance limit may be too small for most spending other than urgent bills or groceries. The qualifying direct deposit of $1,000 is also a tad steep.

5. Current Overdrive

- Good: Loans have a maximum 60-day repayment term, which beats most competitors.

- Bad: The account review process is quite rigorous.

- When to choose this EarnIn alternative: Current Overdrive’s longer repayment terms are its greatest boon.

As another digital bank on this list, Current has its own cash advance service similar to EarnIn, called Overdrive. It grants access to loans worth up to $200 with no overdraft fees.

To be eligible for a loan, you need to receive $500 or more into Current’s checking account within the past 30 days.

Why Is Current Overdrive a Great Option?

A 60-day loan repayment term is one of the best you may find when looking at other cash advance apps like EarnIn. A Current account gives a lot of additional benefits, such as saving pods with competitive APY rates or a card for credit builder loans.

Drawbacks to Current Overdrive

The bank may review each loan request individually, sometimes limiting them based on the status of your checking account. Another potential drawback to Current Overdrive is its link to a Current account, making it impossible for any other bank account to use.

6. Empower Cash Advance

- Good: No late fees, interest, or credit check.

- Bad: A $8 monthly subscription is quite costly.

- When to choose this EarnIn alternative: It’s a sleek, no-nonsense cash advance app that will contain all the essentials without bogging you down with unnecessary features.

Empower Cash Advance is a popular cash advance app that allows loans worth up to $250 per pay period. It integrates with your primary checking account without any credit score checks.

A unique feature of Empower Cash Advance is its flexible repayment date, which you can review before accepting the loan.

Why Is Empower Cash Advance a Great Option?

The service doesn’t demand any late fees or interest. You can also opt to receive an Empower debit card account, which comes with several helpful features. The debit card is compatible with most online payment services.

Drawbacks to Empower Cash Advance

The $8 monthly fee is quite steep. The flexible repayment date is often useful but also adds an element of unpredictability, which can be a nuisance. The 2-5 banking days necessary for payment processing can mean quite a long wait.

7. Revolut Early Salary

- Good: No fees of any sort, supported in 28 international currencies.

- Bad: Limited to paycheck early access.

- When to choose this EarnIn alternative: This is the ideal solution for users who don’t necessarily need loans but would like to receive their paycheck up to two days early.

While it’s not a cash advance app per se, this tool by Revolut lets you get your salary a day or two days in advance, depending on the country.

All it takes is to have your salary directly deposited to a Revolut account instead of a conventional bank.

Why Is Revolut Early Salary a Great Option?

Unlike most other cash advance apps on this list, which tend to be US-exclusive, Revolut Early Salary is broadly available internationally, with payouts available in 28 international currencies. To boot, the service is completely free.

Drawbacks to Revolut Early Salary

The app can only be used for early paycheck access, not actual cash advances. Also, depending on the exact market, your salary may be paid out only a day early, instead of two days.

8. Chime SpotMe

- Good: Covers up to $200 in overdrafts with no fees.

- Bad: Only available to Chime users as overdraft coverage.

- When to choose this EarnIn alternative: Chime is the perfect solution for users who are anxious about overdraft fees without necessarily needing cash advances.

Chime offers a suite of personal finance and banking services that includes SpotMe, a cash advance app similar to EarnIn.

To be eligible for SpotMe, a direct deposit of at least $2000 in a Chime account is required.

Why Is Chime SpotMe a Great Option?

A Chime account comes with many useful features, including a savings account and a credit builder card. SpotMe also lets you access your paycheck two days earlier and is free to use, with no subscriptions or overdraft fees.

Drawbacks to Chime SpotMe

SpotMe is, unfortunately, only available to Chime users who opt to make a direct deposit of $200 or above. The initial starting limits for overdraft protection are very low, starting at only $20, but eventually scaling to a total of $200 with enough timely repayments.

9. Brigit Instant Cash

- Good: No interest fees, and a nifty overdraft alert feature is included.

- Bad: $9.99 monthly subscription, somewhat slow processing time.

- When to choose this EarnIn alternative: It’s the go-to solution for users looking for an all-in-one financial wellness suite.

Brigit Instant Cash is a tool for cash advances included in the Plus plan for Brigit, an all-in-one financial wellness solution.

While the initial loans start small, there’s a progressive climb in the maximum allowed amount, eventually going up to $250.

Why Is Brigit Instant Cash a Great Option?

With Brigit Instant Cash, you can receive cash loans with no credit check or any interest fees. The Brigit suite includes a lot of useful tools, such as insight tools, identity threat protection, and a credit builder credit card.

Drawbacks to Brigit Instant Cash

The tool isn’t available outside of Brigit’s Plus plan, which costs $99 per month. The regular processing time is somewhat slow, and the instant delivery option is costly for industry standards. Additionally, Brigit needs full access to your bank account, which may hypothetically create security issues.

Notable Mentions: Even More Options to Check Out

There’s a considerable number of apps like Earnin floating around the internet, and the ones mentioned in the list above are only scratching the surface. Here are a few additional notable mentions that you may also want to consider looking into.

MoneyLion Instacash

MoneyLion’s Instacash feature lets RoarMoney account owners, as well as users with a regular checking account, demand cash advances starting at $25 and going up to $500 at %0 APR (annual percentage rate). Standard delivery is free but may take longer for accounts outside of MoneyLion.

There’s a $1 monthly fee for the services, and Turbo delivery can get pricey, especially for external transfers — possibly going up to $8.99. After the payment deadline passes, MoneyLion will make partial payment withdrawals until the repayment is complete.

Payactiv

What makes Payactiv different from most of the other apps like EarnIn on this list is that the service is linked to workplaces rather than individual clients. Once your employer applies Payactiv to the job workflow, it will track your work hours and let you access up to $500 of your earnings in advance.

Apart from the impossibility of using Payactiv outside of your employer’s consent, there may be a $5 fee in case there is no direct deposit.

Cleo

A mobile-exclusive finance aid app, Cleo was designed as an AI tool to help with your finances using a deep-learning model by commenting on your financial decisions with appropriately positive or negative quips. It also includes a gamut of extra features, including cash advances allowing users to borrow a small amount of money, initially ranging from $20 to $70, but with the possibility of raising the limit to $100.

The maximum loans are fairly modest, though, and the app requires a monthly subscription costing $5.99 per month or $14.99 per month, depending on the plan.

Wrapping Up

Out of all the apps like EarnIn listed in the article, Dave ExtraCash is the clear winner. It offers the best overall features when compared to the alternatives and even beats EarnIn in several aspects, mostly due to a lack of a $100 limit on one-time loans, as well as looser eligibility criteria.

Albert Instant comes out as a close second and the best free alternative overall. Despite a lower maximum loan limit per pay period, standing at $250, its complete lack of mandatory fees makes it an extremely viable option for thrifty-minded users.