So you’ve finally decided to start your own business.

Congrats!

Whether it’s running a food truck, selling handmade goods on Amazon, or even buying a fully-operational business, being a business owner is no easy feat and requires a great deal of hard work and dedication.

You also need to prepare and submit all the necessary paperwork to legally set up your business.

You have to obtain an Employer Identification Number so the IRS can accurately identify it for tax purposes.

To apply for an EIN, you can fill out the IRS application form online or submit a completed SS-4 form via mail or fax.

In this article, we’ll explain what an SS-4 form is for, who needs to file it, why it’s important, and how to complete one.

What Is an SS-4?

To understand what an SS-4 is, you first need to know what an employer identification number (EIN) is.

The two are closely linked.

In the United States, the employer identification number, also known as federal tax ID number, is a nine-digit number assigned by the Internal Revenue Service (IRS) to businesses to serve as its unique identifier.

Like a Social Security number (SSN), no two EINs are the same.

The IRS uses the EIN to identify a business correctly. It’s required when filing taxes and managing employee payroll.

It’s also needed if you want to open lines of credit for your business’s operating expenses.

You can’t apply for a business license without an EIN.

Applying for an EIN is one of the first few steps you have to take to register your business.

It’s free to register, though some online companies do it for a fee.

There are two ways you can apply for an EIN:

1. Apply online via the IRS website

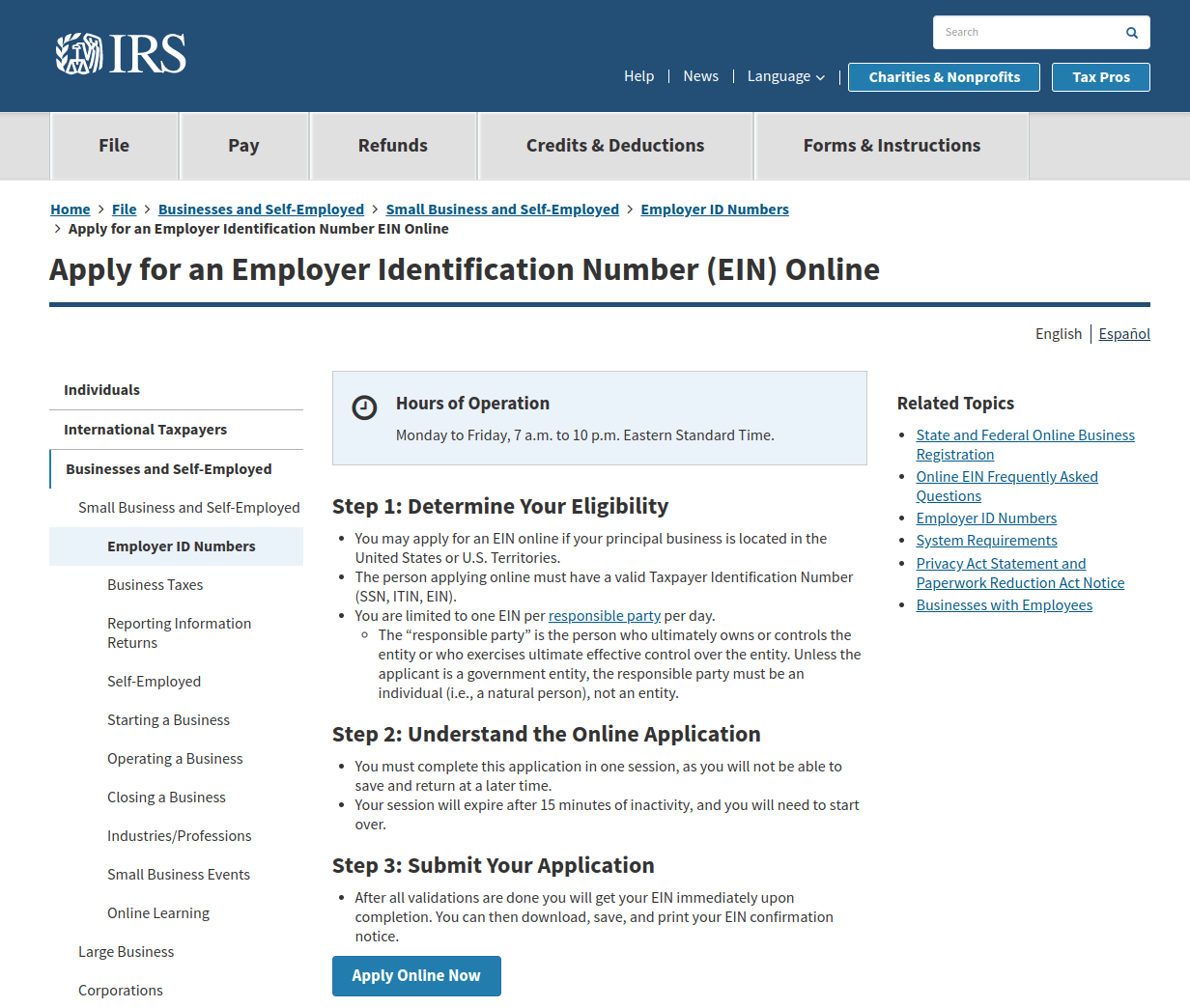

The fastest and most convenient way to apply for an EIN is online.

Simply visit the official IRS page for an EIN application and complete all the required information.

At the end of your online application, you’ll be asked how you want to receive your EIN confirmation letter.

Choosing to receive the letter online allows immediate access.

You can view, save, and print the letter once it’s ready (you’ll receive confirmation within two minutes).

If you opt to receive it via mail, the IRS will send it to the mailing address you provided.

Expect to receive it within four weeks from the time of the application.

2. Apply by faxing a copy of your business’s SS-4 form to the IRS

Download a copy of the official SS-4 form from the IRS website.

It’s two pages, and you can view detailed instructions on the last section of this article on how to complete it.

Who Needs to File a Form SS-4?

You, the business owner, are responsible for applying for an SS-4.

As your company’s “responsible party,” you will be designated as the first point of contact with the IRS for receiving mail and correspondence.

The following types of business entities are required to submit an IRS form SS-4 if they want to apply for an EIN:

Limited Liability Company (LLC) — An LLC is a type of business structure where the owners are not held liable in the event of a lawsuit.

It protects their personal assets if the business gets sued and creditors go after them.

Only multiple-member LLCs will be required to file a form SS-4.

Partnership — A business structure wherein two or more parties formally agree to build or operate a business.

Unlike an LLC or a corporation, the business is not separate from its owners.

When sued or goes into debt, creditors can go after their personal assets.

Corporation — This refers to a business that is treated as a separate entity from its owners.

It has liabilities and rights that are separate from the people who formed it.

Like an LLC, it protects the owners’ personal assets from creditors when the company goes bankrupt.

However, instead of members, a corporation is owned by shareholders.

The types of corporations required to file an

SS-4 are S-corps, real estate investment trusts (REIT), and personal service corporations.

Nonprofit Organization — These are companies that are not taxed on the income they earn due to the charitable nature of their business.

The business still earns money but it isn’t made for the purpose of making an income.

Estate — An estate is a type of entity created as a result of a person’s death.

It refers to the person’s net worth, which includes all of his or her possessions and assets.

Trust — A trust is a legal arrangement that allows one party, the trustee, to keep assets on behalf of the trustor’s beneficiaries (the recipient of the assets).

The following are types of trusts: conservatorships, guardianships, revocable and irrevocable trusts, and custodianships.

Why Is It Important to File an SS-4?

You have to file an SS-4 in order to obtain your business EIN number, which is required if you want to do the following:

- Apply for a business license

- Open a bank account or credit card for your business

- Manage employee payroll and income tax return

- Get lines of credit or loans for your small business

- Establish yourself as an independent contractor

Even if you are not required to have an EIN (say you have a sole proprietorship or single-owner status) the above reasons are enough to make you consider filling out an SS-4 form.

How to Complete an SS-4 Form

Completing an IRS form SS-4 is a pretty straightforward affair.

After downloading a PDF copy of the SS-4, open it and enter the required information. If you’re mailing it in, print it out and grab a pen.

The first section is all about getting your company information.

You’ll be required to complete the following fields:

- Legal name of the entity (or individual) for whom the EIN is being requested — Complete this field by indicating the same exact company name you’ve provided in the articles of incorporation.

- Trade name of business — Complete this if you have filed for DBA (Doing Business As) after forming your LLC.

Since the DBA is owned by the LLC, you should write down the DBA name on this field. - Executor, administrator, trustee, “care of” name — This should be left blank if your business is an LLC.

- Mailing address — Indicate a street address where you can check your mail on a regular basis.

The Internal Revenue Service will be mailing the EIN documents here. - City, state, and ZIP code — For mailing addresses outside of the U.S., the city name, province, zip code, and country name needs to be provided.

- Name of responsible party — This person serves as the IRS’s primary point of contact for the business.

The responsible party controls and manages the company and how its assets and funds are managed.

It should be an actual person unless the responsible party is a government entity. - SSN, ITIN, or EIN — Indicate the SSN, ITIN, or EIN of the responsible party.

- Is this application for a limited liability company (LLC) (or a foreign equivalent)? — Answer either “Yes” or “No.”

The answers to the subsequent related questions such as where the LLC was organized, the number of LLC members, and type of LLC will be based on your initial answer. - Type of entity — Make sure to get professional legal advice before indicating the type of business structure you’ll use for the business.

- Reason for applying — Check the appropriate option showing the reason why you are applying for an EIN. Choices include:

- Started a business

- Hired employees

- Banking purposes

- Changed the type of entity

- Date business was acquired or launched.

- Closing month of the accounting year.

- The highest number of employees expected in the next 12 months.

- First date wages or annuities were paid.

- Principal business category that your company engages in — The options include Construction, Real Estate, Manufacturing, Health Care & Social Service, and Others.

If you check “Others,” specify the industry where you belong. - Indicate the principal line of merchandise sold, specific construction work done, products or services provided — Provide additional information that supports your prior answer.

If you checked real estate, for example, indicate the type of property you’re selling. - Third party designee name and address — Complete this only if you will be authorizing another individual to receive your company’s EIN documents and answer questions about the completion of form SS-4.

The second page of the SS-4 form is informational only.

It’s a guideline showing what course of action to take on specific scenarios.

For example, “If the applicant started a new business and does not currently or expected to have any, then sections 1, 2, 4a–8a, 8b–c (if applicable), 9a, 9b (if applicable), and 10–14 and 16–18 should be completed.”

After completing all required fields, you can then print the SS-4 form and have it either faxed or mailed to the IRS.

If you’ll be sending it via fax, include a return fax number if you can.

Doing so will significantly speed up the time it takes to send back the confirmation paperwork to you.

In the event that another party requires that you present them with your company’s SS-4 (when you’re borrowing money from a lender, for example), you can’t really provide them with copies of the original SS-4 file form.

What you can provide is a copy of your EIN assignment letter instead, which you can request from the IRS.

Ready to Apply for an EIN for Your Business?

While it may sound complicated to newbie business owners, an SS-4 is actually a fairly simple document to complete.

We recommend that you do your due diligence and check with lawyers and accountants before you fill out the SS-4 form so you can avoid costly mistakes.