Just as your Social Security number serves as your personal tax ID number, your employer identification number (EIN) signifies your business in the United States.

While the only nine-digit number you typically need is your own company’s EIN, there are situations in which you’ll need another company’s official identification for tax purposes.

In other cases, you may simply forget your own EIN.

So when the need arises, how do you find a company’s EIN?

Understanding EINs is a critical part of running a small business.

In this article, we’ll thoroughly explain why you need an EIN and why you may need another company’s EIN.

In addition, we’ll provide different methods to help you find the tax identification number you need.

Why Do You Need an EIN?

Some business entities are required by the Internal Revenue Service (IRS) to have an employer identification number.

If any of the following describes your business, you must apply for an EIN:

- You have employees.

- You operate as a corporation, partnership, or limited liability company.

- You file tax returns for employment, excise, alcohol, tobacco, or firearms.

- You withhold taxes on income, other than wages, paid to a non-resident alien.

- You have a Keogh plan.

- You are involved in trusts, estates, real estate mortgage investment conduits, nonprofit organizations, farmers’ cooperatives, or plan administrators.

On the other hand, sole proprietors are a category of individuals who are typically not required to hold an EIN.

Regardless of whether it’s required, many business owners still choose to apply for an EIN, as they’re necessary for some business situations.

For example, some business bank accounts, credit cards, permits, and loans may require you to submit an EIN for authorization purposes.

If you consider any of these to be a significant part of your business needs, we recommend applying for an EIN.

Holding an EIN also prevents you from having to give away your Social Security number on behalf of the company when handling business finances.

Instead, you’ll have a separate, secure federal tax identification number to use on all official forms, which can help protect you from identity theft.

Plus, if you don’t have employees but work with independent contractors, you will need to have an EIN to issue Form 1099s.

Why Would I Need Another Company’s EIN ?

Though holding your own EIN is enough in most scenarios, sometimes you’ll need to request another company’s EIN.

For example, if you have an independent contractor or supplier who you’ve paid over $600 in a single tax year, the IRS may require you to report the transactions, which will require the contractor or supplier’s tax ID number.

You may also need an EIN to receive tax deductions for your charitable contributions and other deductible business transactions.

In addition, you may want another company’s EIN if you’re beginning a long-term or large-scale partnership with them, particularly when both businesses’ finances will be affected.

Keep in mind that private companies are more likely to keep their EINs guarded, as you should too.

Because these are official federal tax ID numbers, just like Social Security numbers, their importance shouldn’t be taken lightly, even if most people won’t have ill intentions.

Business owners typically only hand over their EINs to trusted partners with legitimate reasons to need the information.

How Do You Find a Company’s EIN ?

While EINs aren’t necessarily hard to find, the best method for finding them may not be the most obvious.

In this section, we’ll highlight the easiest ways to find another company’s EIN , as well as your own.

Finding Another Company’s EIN

There are a handful of ways to find an organization’s EIN, but before doing so, it’s important to consider what type of organization you’re looking at.

It’s far easier to find the tax ID numbers of publicly traded companies and nonprofits than to find that of private companies that do not wish to disclose their EINs.

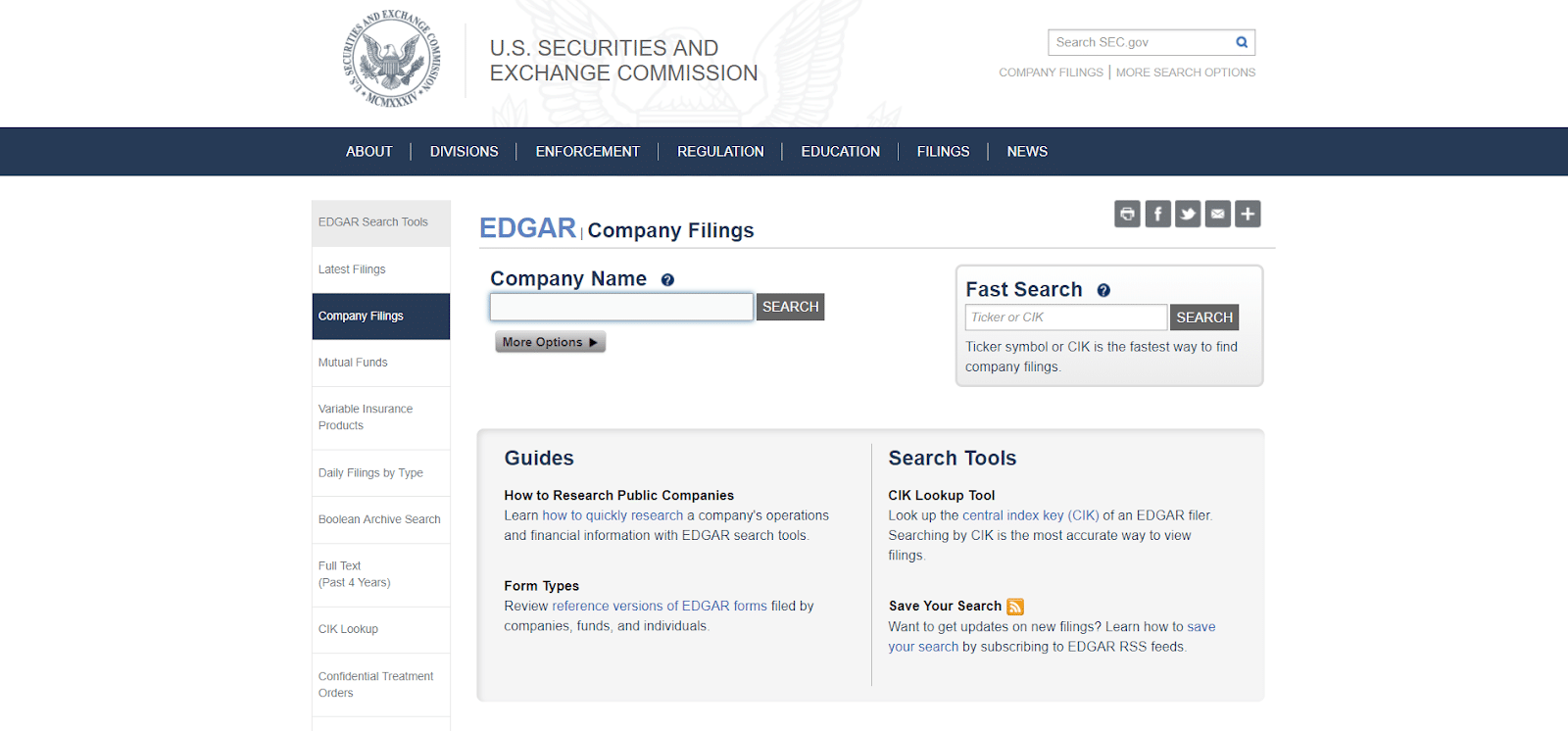

That said, you can easily find the employer identification number of a public company by using the Securities and Exchange Commission’s EIN lookup page.

Simply plug in the business name, tap the hyperlink next to the correct company, and select any official filing.

At the bottom of the page, you’ll see a number listed next to “IRS No.” This is the company’s EIN.

If you need the EIN of a nonprofit organization, the receipt for your company’s charitable contribution will typically have the EIN listed.

If not, the Melissa database provides a fast and free lookup for tax-exempt nonprofits.

Private companies aren’t required to keep their EINs in public records, so the SEC website would be a dead end.

Receipts and invoices are also unlikely to contain the EIN.

Here are a few routes you can take to find a private company’s EIN:

- Ask the company: This is by far the easiest route you can take.

Speaking to the company’s owner, accounting department, payroll division, or human resources department can often get you the fastest answer, especially if you already have a relationship with them.

Otherwise, as long as you can provide a good reason for seeking the EIN, most businesses are fairly understanding. - Request Form W-9: If you’re seeking the EIN of a business or individual who has worked with you in the most recent tax year, you can ask them to fill out Form W-9.

Most professionals understand this is a requirement of some companies, and are often willing to fill it out before even being contracted by you. - Use a paid service: If you’re in critical need of another company’s EIN and they won’t disclose it to you, you can use paid services.

Dedicated EIN finding services (like EIN Finder), attorneys, private investigators, and more typically have access to larger databases and other resources to find an EIN for you.

However, you’re not guaranteed to receive a private EIN, so understand that you should only take this route if necessary, as it can be expensive.

Finding Your EIN

Because you’re clearly authorized to know your own employer identification number, getting a hold of it should be fairly easy.

Here are a few methods you can use to find your company’s EIN:

- Check a past W-2 or tax return: Official tax documents typically include your business’s EIN, including the W-2s you send employees and your annual tax return.

- Contact your bank or local agency: If you have a business bank account, received a loan, or received a local permit or license, you can contact your bank or the relevant state agency to see your EIN.

- Check your EIN application records: When you first applied for an EIN, you should have received an email or physical confirmation letter that lists your EIN.

- Call the IRS: The IRS has a Business and Specialty Tax Line (800-829-4933) that you can contact on weekdays from 7 a.m. to 7 p.m in most US time zones (Alaska and Hawaii residents should use Pacific Time).

As long as you’re an authorized person for your business, you’ll be able to retrieve your EIN easily, though you may be on hold for a significant amount of time.

Frequently Asked Questions

Now that you understand how to retrieve the EIN you need, learn about your tax ID number by taking a look at our answers to these frequently asked questions:

1. How do I apply for an EIN?

If you need an EIN or are interested in receiving one, you can head to this irs.gov page and select “Apply Online Now.”

As long as your principal business occurs in the United States and you have some form of tax identification number (your Social Security number is fine), you should be able to complete the process fairly quickly.

2. Do I ever need to change my company’s EIN?

Some situations may require a change in EIN.

These situations won’t occur frequently, but they most often occur when your business structure changes in any way.

For example, when you’re transferring ownership of your business to someone else or when your business entity changes (i.e., by going from a sole proprietorship to an LLC), the same EIN can no longer be used for any purpose in the future.

3. How much does an EIN cost?

An EIN should be absolutely free as long as you apply straight through the IRS website.

This unique number requires no filing fees.

Plenty of online services ask business owners to pay in exchange for an EIN, but you’re really just paying a relatively large sum of money for their services when the process isn’t difficult at all.

Verify Businesses With EINs

Many business owners gravitate toward employer identification numbers for both the securities and the opportunities they provide.

However, it’s not uncommon for you to forget your own EIN, and it’s not unheard of to need another organization’s EIN.

With this guide, you’ll be able to uncover other companies’ EINs and rediscover your own EIN with ease.

Once you have your EIN, check out this article to learn how you can keep your books balanced with accrual accounting.

With your EIN and good financial records, you’ll be prepared for anything that tax season sends your way.