Whether you want to earn money through investments or borrow money for your personal needs, finding the right resources can be the hardest part of getting started.

With LendingClub, you can get connected directly to peers who can help you meet your financial goals.

LendingClub is a peer-to-peer lending platform that allows any qualified person to become a borrower or an investor straight from home.

The company was built to reduce the red tape associated with financial institutions and help you achieve the future you want faster.

Since the company was founded, it has facilitated the transactions of over $53 billion in loans.

If LendingClub sounds like a great opportunity for your needs, keep reading to learn more about how exactly the company works — and whether or not it’s worth your time.

How LendingClub Works for Borrowers

Whether you’re itching to start a home improvement project or you’re searching for a credit card debt consolidation loan, LendingClub can match you with an everyday investor who has the money you need.

As a borrower, you can get a personal loan worth $1,000 to $40,000 in as little as four days — no collateral needed.

So what’s the catch?

There are two glaring differences between a LendingClub loan and a traditional loan.

First, you must pay the company a one-time origination fee (about 1% to 6% of your loan amount) for connecting you to your investor.

Second, the platform can’t guarantee you’ll receive the loan, as peer lenders have full power over their personal investments.

Still, as long as you fit the bill for an ideal borrower, there’s a strong chance you’ll be able to find a perfect peer lender match.

Borrower Requirements

Much like traditional loan providers, LendingClub does set minimum requirements for borrowers to protect investors, protect itself, and abide by regulations.

Before applying, be aware that you must minimally:

- Be at least 18 years old.

- Be a citizen or permanent resident of any U.S. state, except Iowa. Valid, long-term visa holders who currently live in the United States also qualify.

- Own a bank account that can be verified.

Once you pass these qualifications, you’ll be further evaluated based on the following factors:

- Credit score: Borrowers only need a credit score of 600, though good credit can help you get better loan terms.

- Credit history: You must have at least three full years of credit history. You’ll also be considered based on how reliably you’ve made payments in the past.

- Income: High-income applicants are more likely to receive the best loan terms.

- Current debt: Your debt-to-income ratio cannot exceed 40%.

LendingClub will also consider any information provided in your loan application or by credit bureaus.

If you’re worried that you won’t qualify or that you’ll be stuck with higher interest rates, you do have the option to apply with a co-borrower.

However, you and your co-borrower must have a combined debt-to-income ratio of less than 35% and will share equal obligation to pay off the loan.

Loan Terms

While the exact details of your loan terms will vary based on factors like your credit report and income, you can rely on your annual percentage rate (APR) falling between 6.95% and 35.89%.

Your APR combines your interest rate and your origination fee.

A 14% interest rate is average with LendingClub.

This is slightly higher than the national average for personal loans, but falls into the average range for unsecured loans.

You can select a repayment term of three years or five years, both of which require fixed monthly payments.

Any personal loan you take out with LendingClub is free of prepayment penalties, so you can pay off your full debt as soon as you have the money to do so — no extra fees involved.

However, failing to have enough money in your bank account for your automatic payments and paying late can lead to extra fees.

These are typically no more than $15 or 5% of your required monthly payment.

Your personal loan can be used for a wide variety of purposes, ranging from covering medical expenses to paying for a vacation.

If you have a small business idea you want to fund or a car you want to pay off faster, you can check out LendingClub’s business loan and auto loan refinancing options.

However, these types of loans are not part of the company’s peer-to-peer business model and come with different terms.

Signing Up as a Borrower

One of the biggest perks of borrowing through LendingClub is the simplicity of the loan application process.

All you need to do is complete this short online form with details about:

- Your co-borrower, if applicable

- Your birthday

- Your total annual income

- Your desired loan amount

- Your loan purpose

- Your first and last name

- Your email address

You’ll be asked to provide further details — including your employment information and Social Security number — after you get a chance to preview the loan terms and upfront fees you qualify for.

The last step before you receive your loan is a credit check.

This will come up as a soft inquiry, so you won’t have to worry about it impacting your credit score.

How LendingClub Works for Investors

If you want to invest money in your peers instead of being fully subject to the state of the stock market, LendingClub is a great opportunity for alternative investment.

Instead of purchasing traditional securities, you can use this platform to purchase “Notes,” which are fractions of borrowers’ loans.

In order to invest in a Note, you’ll need to put in a minimum $25 investment.

The more Notes you have, the more diversified your LendingClub portfolio becomes.

However, LendingClub does require users to agree that they will not invest more than 10% of their total net worth.

While LendingClub takes a fairly hands-off approach, compared to robo-advisors like Betterment and Ellevest, it does provide the most important information for you to decide what Notes to invest in.

In addition to showing you information about a borrower’s credit history — without personal identifiable information — it also provides loan grades for every Note.

These loan grades range between A1 (great credit history, but low-interest loans) and D5 (weak credit history, but high-interest loans).

Borrowers are also screened on your behalf, so you don’t have to worry about running a background check yourself.

If you don’t want to manually select your notes, you can also automate your investments.

However, you’ll only have control over your preferred loan terms and loan grade range, which doesn’t completely protect you from high-risk loans.

Investor Requirements

Before you start building out your investment account, you’ll want to make sure you qualify to invest in the first place.

LendingClub requires investors to:

- Be at least 18 years old

- Have a valid Social Security number

- Live in any U.S. state, except Ohio

- Be able to deposit at least $1,000 into your account

- Have a minimum income of $70,000 per year ($85,000 in California) or a net worth of $250,000 ($200,000 in California)

Be aware that your investment options are limited if you live in Alaska, Arizona, Florida, New Mexico, New York, North Carolina, North Dakota, Pennsylvania, or Texas.

While most LendingClub investors can invest directly in Notes, residents of these states can only buy pre-purchased Notes through LendingClub’s secondary market, the Note Trading Platform.

Potential Earnings

While your earnings fully depend on how much you’re investing, LendingClub has reported historical returns of 4% to 7%.

In addition to offering these attractive return rates, you can also receive monthly payments from each Note.

However, there are ongoing fees you need to be aware of.

Because you’re investing through LendingClub, you’re required to pay a 1% service fee on all of your earnings, so not all of the loan proceeds go directly to you.

Though this fee may be low, you always run the risk of paying collection fees if a borrower misses a payment or outright defaults on a loan.

Collection fees can be as high as 40% in the case that litigation was required to collect the remainder of a delinquent loan.

Also keep in mind that tax is not withheld from your earnings, so you’ll want to consult your accountant about how much you can expect to pay on your returns.

Investor Risks

Your investments with LendingClub do carry risk, just as with any type of security.

Borrowers can default on their unsecured loans, leaving you to pay hefty fees.

However, by diversifying your profile, you can greatly minimize your risk.

Any cash in your LendingClub account that you don’t invest is insured by the Federal Deposit Insurance Corporation (FDIC).

Still, be aware before you sign up that you’ll have little guidance when it comes to investing or trading.

Though unlikely to occur, you also won’t have much protection in the case that LendingClub itself goes bankrupt.

Signing Up as a Lender

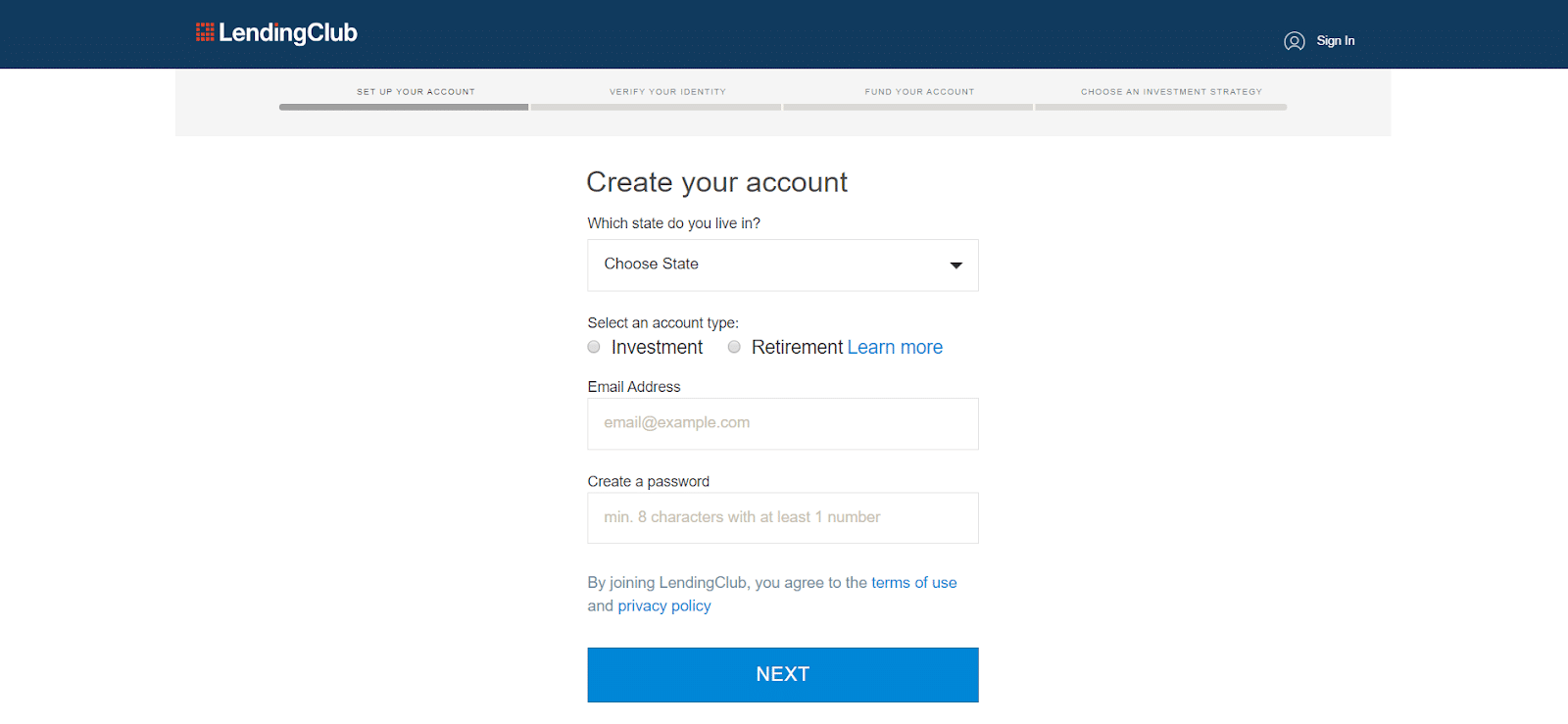

If you’re committed to starting your investment journey with LendingClub, you can create your account on this signup page.

Here, you’ll find that you have two account options: Investment and Retirement.

Both types of accounts allow you to meet your financial goals through investment.

The biggest difference is that a Retirement account doubles as a traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA — whichever you end up choosing.

The Retirement account also requires an additional registration and a minimum $5,500 deposit.

Is LendingClub Legit?

LendingClub is a reputable financial services company that has been accredited by the Better Business Bureau since 2008.

Though investments and loans on the platform aren’t always perfect, LendingClub has successfully facilitated billions of dollars in loans and maintains a three-star rating on Consumer Affairs.

Still, it’s important to acknowledge that the company has seen its fair share of issues in the recent past.

Most notably, LendingClub was hit with charges from the Federal Trade Commission (FTC) in 2018 — the same year its founder, Renaud Laplanche, was caught up in a fraud scandal.

The good news is, LendingClub has proven to be active in resolving customer complaints.

Today, LendingClub remains the largest online marketplace of peer lenders and borrowers and is a great alternative to traditional bank loans and investments.