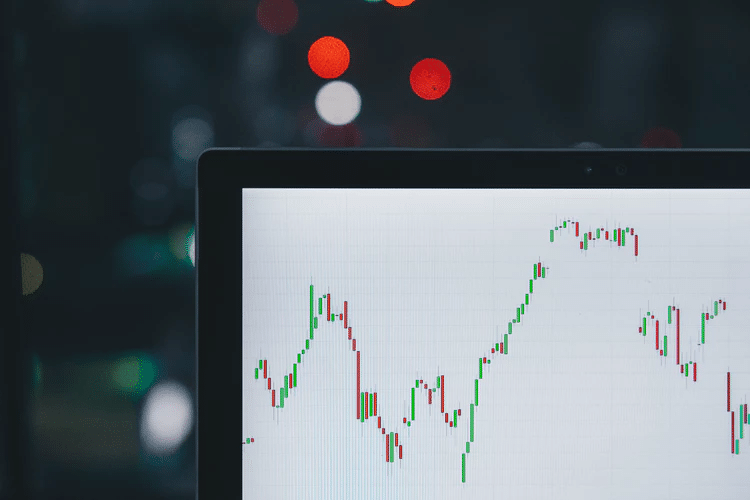

Numerous statistics demonstrate that when it comes to investing, Millenials are well behind other generations. Perhaps it’s because they’re scared of the stock market or because they aren’t sure how to get started.

No matter the reason why, it’s imperative that millennials begin investing now, while time is still on their side. Fortunately, there are apps available that make it easier than ever to open investment accounts, simplifying the process for new investors.

One such example is Acorns, a micro-investing app that allows you to make small investments with your spare change. When making a purchase, Acorns will round-up your transaction to the nearest dollar, investing the difference. Curious about whether the app is right for you? In this Acorns review, we’ll detail everything you need to know so that you can determine whether it’s the right investment vehicle for you.

What Is the Acorns App?

Acorns is a personal finance investment app that allows you to invest your spare change. The company’s website states that its “mission is to look after the financial best interests of the up-and-coming, beginning with the empowering step of micro-investing.”

Walter and Jeff Cruttenden founded the company, launching it on August 26, 2014. Acorns has received backing from prominent investors, including:

- PayPal

- Bain Capital

- BlackRock

- NBCUniversal

- Comcast Ventures

Acorns is part of a new class of investment vehicles known as a robo-advisor. In the past, if you wanted to invest, you either needed the technical know-how to do so or needed to contact a wealth manager. Many wealth managers only work with a minimum amount of money and charge high management fees and commissions.

Robo-advisors, on the other hand, are entirely automated. These investment vehicles are driven by algorithms, requiring little to no human supervision. This is one of the reasons why Acorns is so appealing to millennials — they can open an investment portfolio quickly for a low monthly fee. Other apps that offer access to this “modern portfolio” include:

How Does the Acorns App Work?

When visiting the Acorns website, you’ll find that there are a few different features. We’ll take a closer look at each.

Acorns Core

Acorns Core is the company’s fundamental feature. Core is what allows users to invest using spare change from rounding up the purchases they make on their credit or debit card. Funds are directed into exchange-traded funds (ETFs), which are holdings of stocks and bonds.

Investors determine how risky they would like to be with their investments. The robo-advising algorithm will then select a diversified portfolio, directing the investor’s funds across an array of asset classes. Asset classes that Acorns uses include:

- Real estate

- Government bonds

- Small companies

- Large companies

- Corporate bonds

- Emerging markets

Dr. Harry Markowitz, a Nobel Prize-winning economist, created the company’s algorithm. Markowitz is the father of the modern portfolio theory. When the market moves, the algorithm adjusts accordingly.

Users can choose to fund their Core account in numerous different ways. The easiest is Invest the Change, which automatically invests spare change from purchases on linked debit and credit cards. They can also set up Recurring Investments, which automatically withdrawals money from a checking or savings account weekly, monthly, or annually. Or investors can fund their account with one-time transactions instead of recurring deposits.

Acorns Later

Those who are more focused on funding a retirement account will want to consider another of the company’s investment options, Acorns Later. Acorns Later provides investors with an IRA that they can use for retirement savings. Options include Traditional IRAs, Roth IRAs, and SEP IRAs. The minimum investment to get started with Acorns Later is only $5.

The robo-advisor will consider your current financial situation and goals, and then recommend the proper IRA account and portfolio for you. Your IRA will grow with you as you age and automatically shift to align with your goals as you near retirement.

Acorns Spend

If you’re “all-in” on the Acorns experience, you may also want to consider its Spend feature. Acorns Spend provides customers with a checking account and debit card. You’ll have access to digital direct deposit, mobile check deposit, unlimited free ATM transactions, and free bank-to-bank transfers. There are also no overdraft fees associated with the checking account.

Acorns Spend integrates with the company’s Core and Later platforms. When you spend using the debit card, Acorns will automatically round up the transaction and invest the spare change. Acorns will also invest up to 10% from purchases you make at local places that you visit daily. That’s in addition to the money that you earn from its Found Money feature.

Acorns Found Money

Acorns Found Money is an excellent way to earn free cashback when shopping with your favorite companies. All you need to do is make sure the card on your Acorns account is the same one that you use when making a transaction with a participating company. If you do, the company will automatically invest in your Acorns account. Some of the participating companies include:

- Airbnb

- Blue Apron

- DirectTV

- Experian

- Groupon

- Walmart

There are more than 200 Found Money partners currently available through Acorns. It can take up to 120 days for Found Money funds to appear in your account.

Acorns Grow

Acorns’ Grow feature seeks to provide new investors with the information they need to be successful. Acorns created Grow in partnership with CNBC. Whether an investor is looking to learn more about the Modern Portfolio Theory or real estate investing, they can find everything they need to know in the Grow resource center.

What Are Acorns’ Fees?

One of the most significant benefits of Acorns is that there is no minimum balance required to get started. You can grow your Acorns account gradually over time, instead of having to put down a hefty initial deposit.

Acorns charges fees in three different tiers. All prices are monthly fees, instead of annual fees. The fees we’ll discuss are for those who have less than $1 million invested in their Acorns portfolio. Once you have over a million dollars, the costs increase to $100 per month per million dollars invested.

Users can pay a $1 per month fee for access to Acorns Core. College students do not have to pay a fee to use Acorns Core, so long as they are under 24 years of age and enroll with a .edu email address.

Investors can pay a $2 per month fee to use Acorns Core and Acorns Later. They can also elect to pay a $3 per month fee to add Acorns Spend to their package as well. College students are required to pay the monthly payment on the $2 per month and $3 per month plans.

How to Sign Up for Acorns

Before signing up, you’ll want to have access to the Acorns platform. In addition to visiting Acorns.com, you can download the mobile app for your iPhone and Android smartphones. The mobile app allows you to manage their portfolio in real-time so that you can do things like view your account balance or set up recurring investments.

Once you’re ready, you’ll head to the sign up page. You’ll first create an account login. Then, you’ll select which features you’d like to use and how much you’re willing to pay in monthly fees. Then you’ll provide personal information, including things like your Social Security number, and you’ll give Acorns access to your bank account and credit card.

Customers can trust that their information is safe when using Acorns. Acorns is a member of the Securities Investor Protection Corporation (SIPC). Investors are also FDIC-insured on Acorns portfolios as large as $250,000. And the company uses 256-bit data encryption to protect user information.

Is Acorns Worth It?

So is Acorns worth it? If you’re a new investor who is tired of seeing passive income sitting in your checking account, collecting little interest, then Acorns could be for you. The bottom line is that Acorns is an app that’s incredibly convenient to use and operate. It’s certainly easier to set up and fund than an exchange-traded fund from, say, Vanguard. And, the company is not a scam by any means. Customers can trust that their private information is safe when using the app.

The one downside that you need to be aware of is fees. Although Acorns’ costs are low compared to traditional wealth management advisors, you are also engaging in micro-investing. This means that you’re investing a few cents at a time. If you don’t use Acorns investments correctly, you could end up losing money on fees. Your rate of return can vary depending on the performance of index funds and how much risk you elect to take on.