At some point in our adult lives, we realize that we don’t know much about our finances.

The money is deposited in the bank at the beginning of each month; we pay rent and buy groceries and just go from there.

Eventually, you want to learn more about managing your money and wealth, saving it, and maybe even investing it wisely. This is where a course in wealth management comes into play.

On the other hand, you may be a professional working in finance searching for a certified course or specialization designed to teach you more about a different financial advisory branch and take your career to the next level.

The courses included in this article are aimed at both beginners searching for courses about personal wealth management and professionals wanting to enhance their knowledge and explore a different part of the financial world.

If you have been digging through the internet searching for the best Wealth Management courses online, look no further! We have curated a list of the best Wealth Management courses online.

We have ranked the following courses based on the highest number of 5-star ratings, certification availability, instructor quality, and student reviews.

- The Best Wealth Management Courses Online

- 1. Wealth Management Theory and Practise (Yale School of Management)

- 2. The Personal Finance and Wealth Management Masterclass (Udemy)

- 3. Principles of Wealth Management (FutureLearn)

- 4. Personal and Family Financial Planning (Coursera)

- 5. Professional Certificate in Personal Finance (edX)

- 6. Investment and Portfolio Management (Coursera)

- Here are some FAQs about a course in Wealth Management.

The Best Wealth Management Courses Online

1. Wealth Management Theory and Practise (Yale School of Management)

This is the best Wealth Management course online. It is ideal for intermediate to advanced learners, including those of you who are financial planners, investment consultants, wealth managers, and tax and estate professionals.

The certification for this is administered by the Investments and Wealth Institute®, which is the standard for competence in the field of wealth management today. This certification is called the Certified Private Wealth Advisor (CPWA.)

It is taught by several highly qualified members of the Yale faculty. They are:

- Jim Dobbs, a Carnegie Mellon graduate, financial advisor, and founder of the Dobbs Wealth Management Group, LLC.

- Tobias “Toby” Moskowitz, a winner of the prestigious 2007 Fischer Black Prize from the American Finance Association for his “ingenious and careful use of newly available data to address fundamental questions in finance.”

- Micheal E. Kitces, the Head of Strategy at Buckingham Wealth Partners.

- John Nersesian, the Head of Advisor Education at PIMCO. He was also a former vice president at Merrill Lynch.

- Richard Joyner, the president of Tolleson Wealth Management.

- Steven G. Siegel, a published author, Georgetown graduate, and adjunct professor of law at the University of Alabama

- Gal Zauberman, a Professor of Marketing at Yale.

The prerequisite for this course is a foundational understanding of financial planning concepts and applications. This includes retirement planning, tax, investing, charitable, and estate planning.

This course costs $6,995 for Investment and Wealth Institute members and $7,390 for non-members; this cost includes institute application and testing fees. It is self-paced, and the ongoing enrollment allows you to begin whenever you’re ready. CPWA candidates from Yale have demonstrated higher pass rates on the certification exam. Additionally, program participants have given the program an overall rating of 4.81/5.00 for efficacy, 4.80/5.00 for helping them prepare for the certification exam, and a participant support rating of 4.89/5.00.

Review by Alyce Z:

“Thank you! I very much appreciated the coursework and prep material. I closely followed the recommendations that were outlined in the material about how to approach the course – and the exam prep in particular. I was very pleased with the result! Above all, I can say with certainty that going through this course armed me with knowledge and confidence about the complex topics that are very relevant to help our team better serve our clients. I’m most thankful for that. Thank you again for your note and for the outstanding course and exam preparation. I’m very appreciative!”

Click here to sign up.

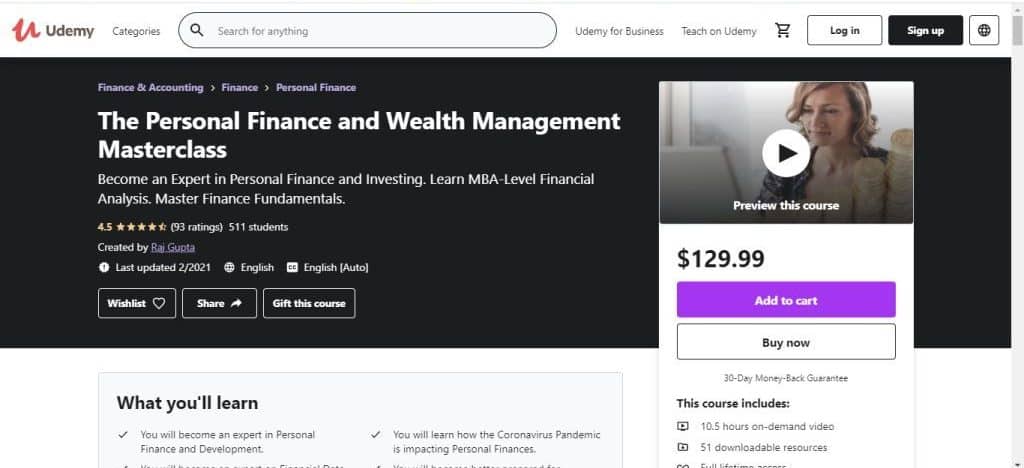

2. The Personal Finance and Wealth Management Masterclass (Udemy)

This course is perfect for those of you interested in becoming an expert in Personal Finance and Wealth Management, regardless of your educational background. If you are a high school or college instructor, you can incorporate the curriculum from this course into your syllabi.

Raj Gupta teaches this course. He holds a Ph.D. in Finance from the University of Massachusetts, Amherst, and he is the Chief Financial Officer of the American College of Healthcare Trustees. Dr. Gupta has also published various articles on different financial topics, and he has recently authored a Financial Literacy and Essential Data Handbook.

Features of the Course:

- Certificate of Completion

- 10.5 hours of video footage

- 76 lectures

- 51 downloadable resources

- Assignments

- Access on mobile devices and television

- Full lifetime access to the course

What You’ll Learn:

- How households invest money

- Financial planning tools

- Asset allocation

- Role of financial markets and institutions

- Risk management

- Estate planning

This course has a 4.5-star rating, and over 500 students have taken it.

Review by Renan Felipe dos Santos:

“Excellent course. Focuses on reliable sources of financial information and deals with important topics such as time value of money, how to calculate future and the present value of investments, comparing total returns and premium risks. Really went beyond personal finances and into wealth building and management.”

3. Principles of Wealth Management (FutureLearn)

We would highly recommend this prestigious course for undergraduate and postgraduate students and professional practitioners working in the wealth management industry.

Hanken School of Economics developed this course. It is a triple crown accredited Finnish university with several years of experience in education and research in business. Three instructors teach this course: Björn Wahlroos, Jan Antell, and Niclas Meyer. Wahlroos is a former professor with over 35 years of experience in the financial industry as an investment banker. Antell is an associate professor in Finance at Hanken; his specialization lies in finance, wealth management, and quantitative finance. Meyer holds a doctorate in Finance from Hanken, and he is a postdoctoral researcher in Finance with a background in financial economics and mathematics.

Features of the course:

- Seven weeks long

- Requires 4 hours of study a week

What You’ll Learn:

- Portfolio theory

- The wealth management process

- Market efficiency

- Diversification

- Negative interest rates

- Time value of money

- Asset classes

This course has a 4.8-star rating, and over 7,900 students have signed up for it.

Review by Vince K.

“This was a great introduction to wealth management. I am retired and managing my own drawdown pension and ISA’s, so wealth management is important to me. I have done a couple of courses over the past five years, this one was to be a refresher, but I must say it was much more than that. The content was excellent, just the right level for me, much more relevant than other courses as I focus on funds rather than shares, and other courses tended to focus mainly on shares. It’s prompted me to increase the diligence and techniques I use to review my portfolio. I intend to repeat this course very soon; it was well delivered, enjoyable, and has increased my knowledge and confidence with managing my pension.”

Please note: At present, the course is closed for enrollment. However, when you sign up for this course, you will receive an email containing information about when the course reopens.

4. Personal and Family Financial Planning (Coursera)

We would highly recommend this course for young adults and beginners interested in learning more about managing their finance and overall wealth management. The introductory-level content is perfect for those who don’t know where to start learning about financial and wealth management.

Dr. Micheal S. Gutter teaches this course. He is an associate professor, interim family and state program leader, and financial management state specialist for the department of family, youth, and community sciences in the Institute of Food and Agriculture at the University of Florida. Gutter currently serves on the Editorial Board for the Journal of Financial Counseling and Planning.

Features of the course:

- Nine weeks long

- Requires half an hour to two hours of study per week

- Self-paced

- Includes a shareable certificate of completion

- Flexible deadlines

- 13 quizzes

- Nine reading materials

- Subtitles available in Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Please note: A shareable Certificate of Completion is available with Coursera Plus. Coursera Plus costs $388.65 a year, with a 14-day money-back guarantee. If you purchase the certificate, you will gain access to all the course materials and graded assignments. Once you have completed the course, your electronic Certificate will be added to your Accomplishments page, where you can print or add it to your LinkedIn profile.

What You’ll Learn:

- How to understand personal finance

- Financial statements, tools, and budgets

- Managing income taxes

- Building and maintaining good credit

- Investment fundamentals

- Managing risk

- Investing through mutual funds

- A personal plan of action

Over 126,000 students have taken this course. It also has a 4.6-star rating on Coursera. 14% of learners started a new career after completing this course, 36% of learners got tangible career benefits from it. Additionally, 22% of learners got a pay increase or promotion after completing this course.

Review by Darshan M D:

“One of the best courses for anyone not familiar with any financial concept, and also for the professionals as a refresher course of the basics. This will help the learner to know the importance of financial management, and learn the skills of managing finance, and plan for the future. Prof. Gutter explains well and in an easy-to-understand language without jargon. The assignments and readings are interesting, have the right level of challenge without being too difficult, or have complicated calculations. The majority of the concepts are generally applicable regardless of your location. Even those with US laws or other specific things can be easily understandable as they are similar to the laws in the other nations. Highly recommended!”

5. Professional Certificate in Personal Finance (edX)

We have included this Professional Certification in Personal Finance for those of you who want to learn about personal wealth management and understand your finances.

This professional certificate is conducted by Indiana University and is taught by Kenneth Carrow and Todd Robertson. Carrow is a Professor of Finance at Indiana University Kelley School of Business Indianapolis whose research interests include financial institutions and deregulation of markets. Robertson is a former Senior Lecturer at Kelley School of Business with over 15 years of experience in higher education, Corporate Finance, Personal Finance, and Social Entrepreneurship.

Indiana University’s Professional Certificate consists of the following three courses:

- Introduction to Personal Financial Planning

- Managing Personal Cash and Credit

- Planning for Risk and Retirement

Features of the Certification:

- Three courses

- Three months long to complete

- Requires 4-6 hours of study per week

- Self-paced

Please note that you will not receive the certificate itself for free while you can audit the courses within the Certificate for free. The cost of the Professional Certificate is $537.

What You’ll Learn:

- Establish your budget with financial integrity

- Plan for retirement

- Understand your income needs based on your current lifestyle

- Plan for success and financial security

- Manage risk in a cost-effective and productive manner

- Create personal freedom and build wealth through a broad perspective of investing

Here is some information about the job outlooks that come with this Certification:

- Financial security creates a balance in life that makes it possible to enjoy both work and home.

- Personal financial planning contributes to the fulfillment and improved quality of life.

- Financial planning decreases stress to allow you to focus on your career goals.

- Your wise use of credit is an asset to employers who may require a credit check as a term of employment.

- When you understand personal finance, you can apply your skills to become a more valuable employee.

- If you’re looking to start your own business, financial knowledge equips you with a competitive edge.

6. Investment and Portfolio Management (Coursera)

The next item on our list is a Coursera Specialization for beginners interested in knowing more about the investment aspect of Wealth Management. In this course, you will learn theory and real-world skills necessary to design, execute, and evaluate investment proposals that meet financial objectives. There is also a Capstone Project in the fifth course of the Specialization. You will get a chance to show off the analytical tools, quantitative skills, and practical knowledge learned that is necessary for long-term investment and Wealth Management success.

The Specialization is conducted by Rice University and taught by Dr. Arzu Ozoguz and Jill Foote. Dr. Ozoguz is a visiting assistant professor of finance at the Jesse H. Jones Graduate School of Business at Rice University, whose work focuses on how the information environment in financial markets affects asset prices and the dynamics of asset prices cross-section of stock returns. Foote is also a faculty member at Jones Graduate School of Business.

Rice University’s Specialization consists of the following courses:

- Global Financial Markets and Instruments

- Portfolio Selection and Risk Management

- Biases and Portfolio Selection

- Investment Strategies and Portfolio Analysis

- Capstone: Building a Winning Investment Portfolio

Features of the Specialization:

- Six months long

- 4-7 hours of study required per week

- Practice quizzes

- Subtitles available in English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish

- Several hours of video footage

- Graded quizzes with feedback

- Graded programming assignments

- Certificate of Completion available with Coursera Plus.

Please note: Coursera Plus costs $388.65 a year, with a 14-day money-back guarantee. If you purchase the certificate, you will gain access to all the course materials and graded assignments. Once you have completed the course, your electronic Certificate will be added to your Accomplishments page, where you can print it or add it to your LinkedIn profile.

What You’ll Learn:

- How to construct optimal portfolios that manage risk effectively

- How to capitalize on understanding behavioral biases and irrational behavior in financial markets

- Practices in portfolio management

- Current investment strategies

Over 38,000 students have completed this Specialization. It also has a 4.5-star rating on Coursera.

Review by Claudio:

Good review of simple financial material. Not an in-depth review, but a good refresher of modules that you would have seen in your MS Finance or MBA Finance.”

Here are some FAQs about a course in Wealth Management.

What is a course in Wealth Management all about?

A Certificate in Wealth Management (or CWM) is a professional program that equips learners like you with the knowledge and training required for managing wealth. It is usually an additional qualification pursued by financial professionals to enhance their career prospects, and it is offered in both full-time and part-time modes.

What does Wealth Management entail?

Wealth Management is an advisory service for investment and financial planning provided by banks and other financial service firms. Wealth advisors address the needs of affluent clients using a consultative approach to learn more about their financial wants and needs and then creates a personalized strategy that uses a range of financial products and services.

Is Wealth Management a promising career?

The field of finance is constantly evolving. A career in wealth management requires you to wear many hats; you must be willing to work on and develop your people skills so that clients trust you with their life savings. You must also remember to keep your clients’ best interests in mind.

With wealth management, you can do various things, including risk identification and management, research and analysis, and strategic partnership.

What are the skills required for Wealth Management?

Some of the skills required are:

-Strong communication skills

-Knowledge of investment products

-Discretion and trustworthiness

-Interest in the financial markets

-Proactivity

-Strong focus on customer service

How much do Wealth Managers make?

The average wealth manager earns between $69,000 and $88,000 a year.